Tariffs, Sanctions Test India-US Alliance Bonds

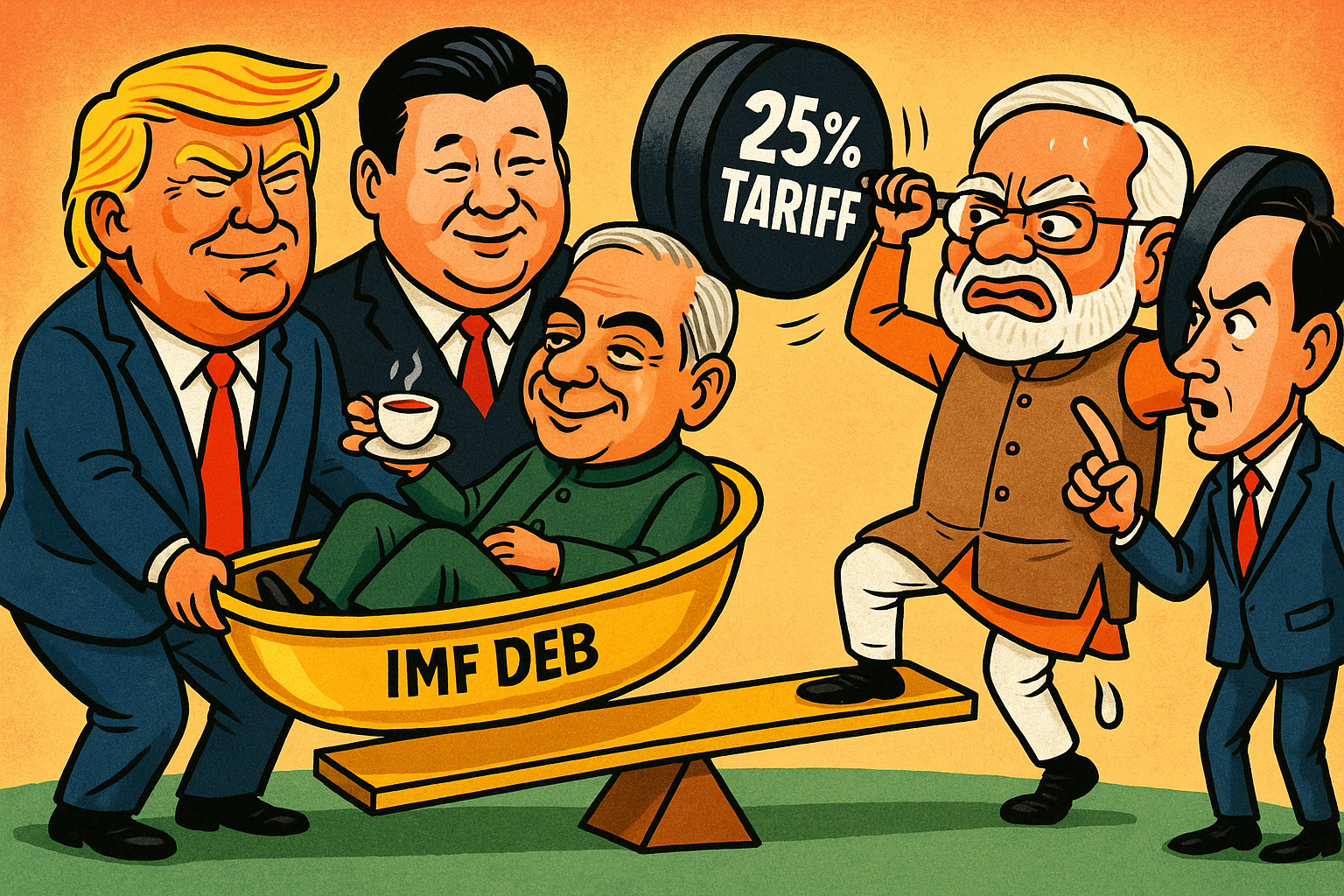

With U.S. tariffs targeting India’s trade and sanctions hitting its firms, is New Delhi being sidelined to prioritise Washington’s strategic alignment with Beijing? Secretary of State Marco Rubio’s July 31, 2025, Fox Radio interview with Brian Kilmeade reveals mounting tensions in India-United States relations, as a 25 per cent tariff on Indian goods and sanctions on seven Indian companies for Iranian petroleum trade take effect. Rubio’s critique of India’s Russian oil imports, contrasted with his emphasis on U.S.-China trade stability and a noted shift toward Pakistan, suggests New Delhi faces disproportionate scrutiny. U.S. President Donald Trump’s expressed keenness to meet Chinese President Xi Jinping, coupled with cautious handling of Taiwanese President Lai Ching-te’s postponed U.S. transit and China’s tariff warnings, raises questions about India’s standing and whether Beijing and New Delhi share common ground against U.S. economic pressures.

Rubio highlighted India’s reliance on Russian oil, which accounts for 35 per cent of its imports, as a “point of irritation” in the alliance. “India is an ally, a strategic partner,” he told Kilmeade, acknowledging New Delhi’s need for affordable energy to fuel its economy, the world’s fifth-largest. However, he stressed, “With so many other oil vendors available, India continues to buy so much from Russia,” noting that discounted Russian crude indirectly sustains Moscow’s war in Ukraine. Rubio’s diplomatic tone preserved the partnership but conveyed clear frustration, while his silence on China’s substantial Russian oil purchases underscored a selective critique. He emphasised “strategic stability” in U.S.-China relations, cautioning that an “all-out trade conflict” between the world’s two largest economies would have a “huge impact” globally. Rubio also noted a recent U.S. shift “more towards Pakistan than India as of late” in trade dynamics, adding complexity given India-Pakistan rivalry. The 25 per cent tariff on Indian goods, effective August 1, 2025, alongside the absence of equivalent measures against China, highlights this uneven approach, suggesting India is under pressure to align with U.S. geopolitical goals.

Also read:

- U.S. Targets Indian Firms in Iran Petroleum Crackdown

- Trump’s Tariff Bombshell Tests Modi’s Diplomacy

- India Reviews US Tariff Threat on Russia Trade

Trump’s keenness to meet Xi further underscores this dynamic. On July 22, 2025, Trump posted on his official X account, stating, “XI HAS INVITED ME TO CHINA,” and expressed intent to meet Xi “in not too distant future,” signalling optimism for a “handshake agreement” to ease trade tensions. Rubio, in a July 11 press briefing in Kuala Lumpur, reinforced this, stating, “The odds are high… both sides want to see it happen,” referring to a potential Trump-Xi meeting. He described his meeting with Chinese Foreign Minister Wang Yi as “very constructive,” noting Trump’s “very positive working relationship with President Xi” from his first term, though no specific date was set. These remarks align with Trump’s June 6 X post, where he described a “very good phone call” with Xi, focused on trade, and confirmed Xi’s invitation to visit China, which he reciprocated.

This enthusiasm for U.S.-China engagement contrasts with the economic pressures on India, suggesting Washington prioritises stabilising ties with Beijing, possibly to secure cooperation on issues like Ukraine, as Rubio hinted.

The U.S. sanctions on seven Indian firms, announced July 30, escalate this strain. Targeted under Executive Order 13846 for facilitating Iran’s illicit petroleum trade, these companies face frozen U.S. assets and exclusion from American transactions, disrupting India’s chemical and industrial supply chains. India’s commerce ministry, on July 31, stated it was evaluating the tariffs’ impact on key exports, including $8.1 billion in pharmaceuticals, but remained silent on the Iran sanctions. The rupee depreciated by 0.8 per cent, reflecting market unease. India’s efforts to diversify oil imports from 40 countries, including a 330,000-barrel-per-day increase from African suppliers, aim to reduce reliance on sanctioned regimes like Russia and Iran. Yet, the sanctions’ focus on Indian firms, without similar actions against Chinese or Pakistani entities, suggests selective enforcement. Rubio’s omission of the Iran issue in his interview reinforces perceptions of India as a target of Washington’s frustration.

The postponed U.S. transit of Taiwanese President Lai Ching-te highlights Washington’s cautious approach to Beijing. On July 29, State Department spokesperson Tammy Bruce called Lai’s travel plans “hypothetical,” affirming U.S. policy under the Taiwan Relations Act and “one China” framework. China’s Foreign Ministry spokesperson Guo Jiakun, on July 30, firmly opposed U.S.-Taiwan interactions, asserting Taiwan’s status as part of China. Rubio’s July 11 remarks clarified that his meeting with Wang Yi did not involve warnings about Lai’s transit, focusing instead on constructive dialogue. This careful handling contrasts with the economic measures against India, suggesting Washington seeks to avoid escalating tensions with Beijing while pressing New Delhi.

Guo’s August 1 tariff stance offers insight into potential China-India alignment. He criticised a 40 per cent U.S. tariff on rerouted goods and the suspension of exemptions on low-value Chinese packages, calling for “fair competition” and warning that “tariff and trade wars have no winners.” These remarks echo India’s concerns about the 25 per cent tariff, suggesting a shared opposition to U.S. protectionism. Both nations, reliant on U.S. markets, face export disruptions—India’s pharmaceuticals and China’s low-value goods. However, China’s exemptions from Iran sanctions and Rubio’s softer tone on Beijing’s Russian oil purchases highlight its stronger diplomatic leverage. India’s strategic autonomy faces a test as it balances U.S. trade ties, energy security, and regional rivalries, particularly with Pakistan’s emerging favour.

India remains a key U.S. ally in the Indo-Pacific through the Quad, countering China’s influence. However, tariffs, sanctions, and the U.S. tilt toward Pakistan signal Washington’s dissatisfaction with New Delhi’s trade and energy choices. Trump’s eagerness for a Xi meeting and Rubio’s focus on U.S.-China stability are strong indicators of the emerging scenario where India is under pressure to conform, while Beijing negotiates from a position of strength. Shared economic grievances could align New Delhi and Beijing against U.S. tariffs, but their divergent treatment underscores India’s challenging position in a shifting geopolitical landscape.