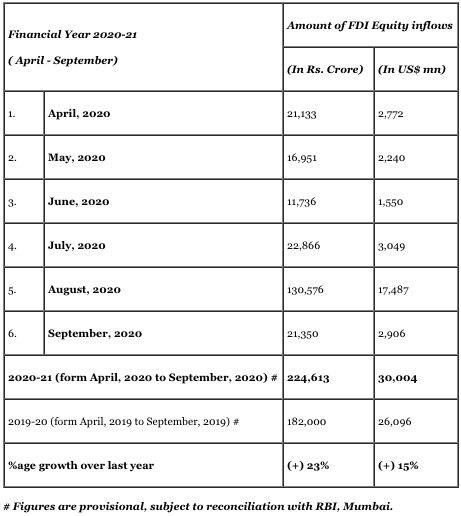

FDI Equity Inflows during the first half of 2020-21 have shown 15% growth in US$ terms and 23% growth in Rupee terms

New Delhi: Total Foreign Direct Investments (FDI) inflows into India during the second quarter of financial year 2020-21 (July, 2020 to September, 2020) have been US$ 28,102 million, the Ministry of Commerce & Industry, stated today.

Out of the total inflow, FDI equity inflows were US$ 23,441 million or Rs. 174,793 crore.This takes the FDI equity inflows during the financial year 2020-21 upto September 2020 to US$30,004 million which is 15% more than the corresponding period of 2019-20. In rupee terms, the FDI Equity inflows of Rs 224,613 Crore are 23% more than the last year. August, 2020 has been the significant month when US$ 17,487 Million FDI equity inflows were reported in the country.

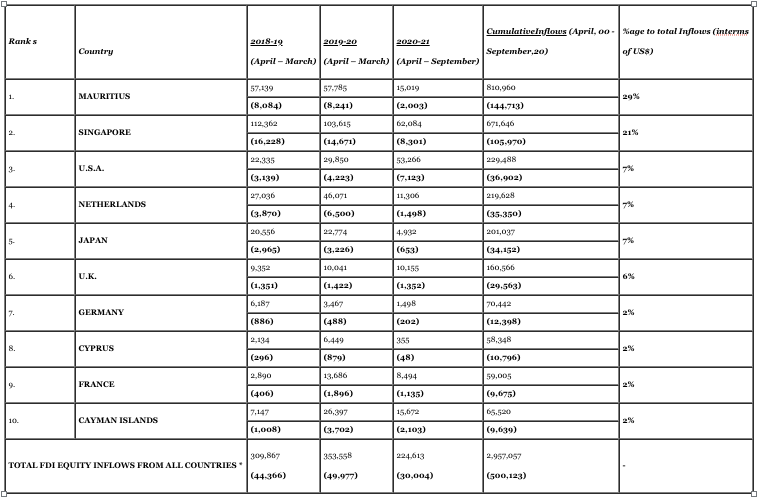

In terms of the Countries from where FDI Equity Inflows were reported to India, during April, 2000 to September, 2020; maximum FDI Equity inflows have been reported from Mauritius, followed by Singapore and the USA.

SHARE OF TOP INVESTING COUNTRIES FDI EQUITY INFLOWS (Financialyears):

Amount in Rupees Crores (in US$ Million)

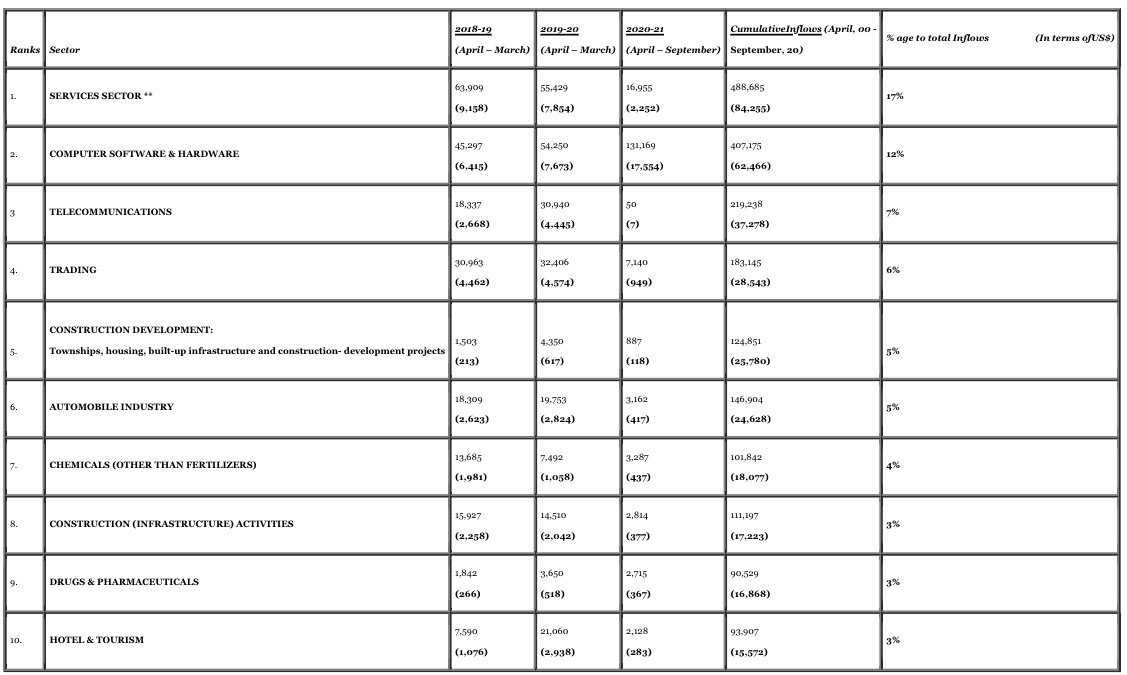

Among the sectors, Services sector has received maximum FDI equity inflows, during April, 2000 to September, 2020; followed by Computer Software & Hardware, and Telecommunications.

SECTORS ATTRACTING HIGHEST FDI EQUITY INFLOWS:

Amount in Rs. Crores (in US$ Million)

Gujarat has been the major beneficiary state of the FDI Equity inflows, during October, 2019 to September, 2020;followed by Maharashtra and Karnataka.

STATES/UTs ATTRACTING HIGHEST FDI EQUITYINFLOWS

Amount in Rupees Crores (in US$ Million)

– globalbihari bureau