New Steel Incentive Targets High-Value Alloys, Exports

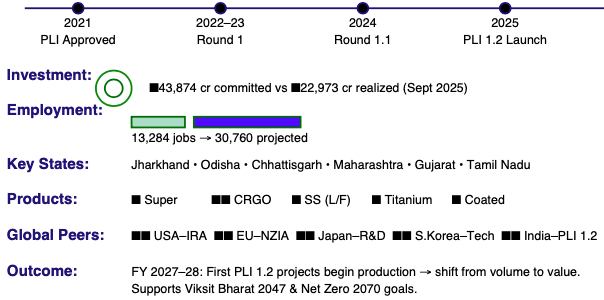

New Delhi: India has launched the third phase of its Production Linked Incentive (PLI) Scheme for Specialty Steel, known as PLI 1.2, aiming to draw fresh investments into advanced alloys and high-grade steel production as part of its strategy to become a global manufacturing hub.

The new round, announced by Union Minister for Steel and Heavy Industries H.D. Kumaraswamy, builds on earlier phases of the scheme that have already attracted ₹43,874 crore in committed investment and created 30,760 direct jobs. With ₹22,973 crore already invested and over 13,000 jobs generated as of September 2025, the government says the initiative has demonstrated “strong industrial confidence” in India’s reform-driven policy framework.

Under PLI 1.2, the Ministry of Steel will invite applications through the online portal https://plimos.mecon.co.in for a 30-day period. The round targets 22 product sub-categories under five broad steel segments, including super alloys, cold-rolled grain-oriented (CRGO) steel, stainless steel long and flat products, titanium alloys, and coated steels — materials that are critical to defence, aerospace, automotive, and clean-energy industries.

Incentives will range from 4 to 15 per cent of incremental sales, applicable for five years starting FY 2025–26, with disbursement beginning in FY 2026–27. The base year for price benchmarking has been revised from FY 2019–20 to FY 2024–25 to reflect current market conditions.

Officials describe the new phase as part of a broader shift from volume-driven to value-driven steel production, positioning India as a supplier of advanced materials in the global value chain. Unlike conventional steel, speciality grades require high precision, controlled processes, and consistent performance under extreme conditions — characteristics that India has historically relied on imports to obtain.

“The PLI scheme stands as a pillar of the Atmanirbhar Bharat vision,” Kumaraswamy said at the launch, calling the initiative “a key step toward a technologically advanced and globally competitive steel industry.”

The PLI Scheme for Specialty Steel, approved by the Union Cabinet in July 2021 with an outlay of ₹6,322 crore, incentivises incremental production of value-added steel grades used across strategic sectors. Collectively, the three rounds of the scheme are projected to add 14.3 million tonnes of new specialty steel capacity, strengthening India’s manufacturing base and reducing import dependence.

![]()

Industry analysts note that this phase introduces a more targeted design — linking incentives directly to measurable sales rather than investment outlay. The focus on emerging categories such as super alloys and titanium-based steels aligns India’s policy direction with trends in advanced manufacturing economies like Japan and South Korea, where government-backed R&D has driven breakthroughs in material science.

By emphasising performance-linked disbursements and revised cost benchmarks, the government aims to create a more realistic framework that accommodates recent inflationary pressures and global price shifts. This adjustment also reflects industry feedback on the need for price updates to ensure effective participation.

Globally, specialty steel demand is being shaped by the energy transition and the defence-industrial reconfiguration that followed geopolitical tensions in Europe and East Asia. High-strength alloys, corrosion-resistant steels, and CRGO products are vital for renewable energy infrastructure, electric vehicles, and grid modernisation — sectors where India’s domestic requirements are expanding rapidly.

India is currently the second-largest steel producer in the world, with total crude steel output exceeding 136 million tonnes in FY 2024–25. However, high-value categories still account for a limited portion of production, with imports meeting much of the demand for specialised grades. PLI 1.2 aims to close that gap and enable Indian mills to supply global markets directly.

The policy’s timing coincides with a gradual shift in industrial investment patterns. As multinational firms seek to diversify manufacturing bases beyond East Asia, India’s combination of cost competitiveness and growing domestic demand is drawing attention. The government sees advanced steelmaking as a strategic capability that underpins other industrial sectors — from shipbuilding and semiconductors to renewable infrastructure.

According to ministry officials, micro, small, and medium enterprises (MSMEs) will also gain opportunities under the new framework, as downstream fabrication and processing capacities expand. Regional employment benefits are expected to rise through new clusters in Jharkhand, Odisha, Chhattisgarh, and western Maharashtra, where several ongoing projects from the first two rounds are now approaching commissioning.

The incentive period through FY 2030–31 is expected to coincide with major national development milestones, including the government’s Viksit Bharat 2047 vision and Net Zero 2070 commitments. Cleaner and more efficient production technologies form part of the government’s broader sustainability agenda, which aims to reduce the carbon intensity of steelmaking through greater use of electric arc furnaces, green hydrogen, and carbon capture systems.

In the global context, India’s PLI framework mirrors similar incentive-led industrial programmes in countries seeking to de-risk supply chains and secure domestic materials for strategic industries. The United States, under its Inflation Reduction Act, and the European Union, through its Net-Zero Industry Act, are also offering targeted support for low-carbon manufacturing. India’s approach, however, remains distinct in linking incentives to incremental output and job creation rather than direct subsidies.

Analysts caution that while the PLI scheme is a positive signal to investors, its effectiveness will depend on infrastructure readiness, logistics efficiency, and R&D collaboration between government, academia, and industry. Specialty steel production demands a consistent energy supply, access to advanced testing facilities, and alignment with international certification norms — areas where India is still building capacity.

Still, the steady progress of the earlier PLI rounds has bolstered investor sentiment. Companies participating in the first two phases have already commissioned or are developing projects across a diverse product mix — from automotive-grade stainless steels to high-tensile rails and electrical steels for transformers.

As PLI 1.2 opens applications, the Ministry of Steel has underscored that technology partnerships and export orientation will be crucial in this phase. Officials said the aim is to enable Indian companies not only to meet domestic requirements but to compete globally in quality-sensitive markets.

“Through this initiative, we aim not just to produce steel for India, but to supply the world from India,” Kumaraswamy said.

The government projects that the next wave of PLI-linked capacity will begin to materialise by FY 2027–28, marking a significant step in India’s industrial diversification. For a sector that once depended heavily on bulk production and price competitiveness, the PLI scheme represents a redefinition of priorities — toward innovation, sustainability, and strategic autonomy.

– global bihari bureau