WTO Trade Barometers

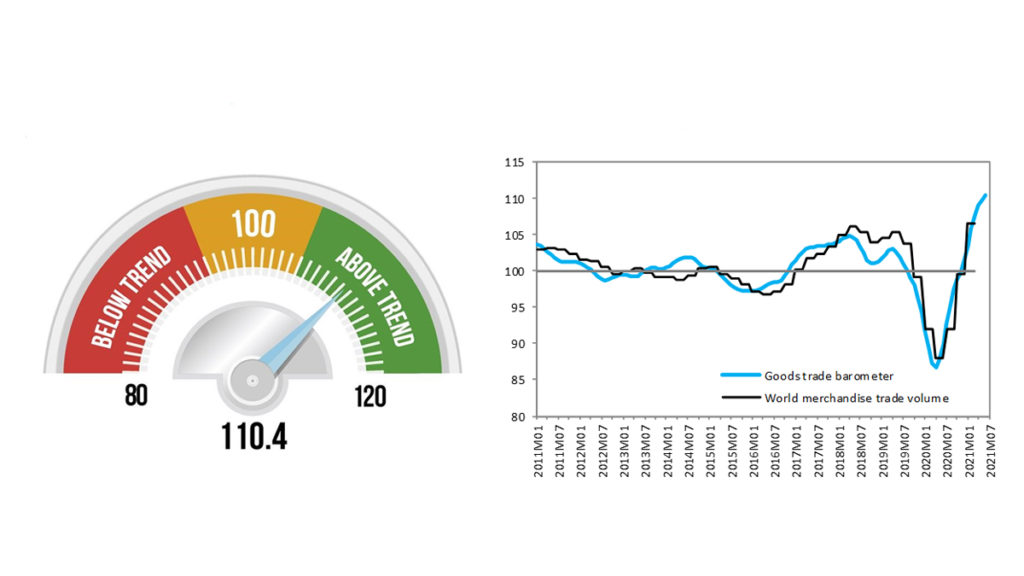

Geneva: Global merchandise trade is continuing its robust recovery from the shock of the COVID-19 pandemic according to the World Trade Organization’s Goods Trade Barometer, which hit a record high in its latest reading issued today.

The latest barometer reading is broadly consistent with the WTO’s most recent trade forecast of March 31, 2021 which foresaw an 8% increase in the volume of world merchandise trade in 2021 following a 5.3% drop in 2020. The sharp decline was in the second quarter of 2020 during the early days of the pandemic. Thereafter, global goods trade has grown steadily.

The volume of merchandise trade was up 5.7% year-on-year in the first quarter of 2021, the largest jump since the 5.8% rise in third quarter of 2011. The latest barometer reading suggests that goods trade will see an even larger year-on-year increase in the second quarter once trade volume data for that period are available.

The volume of merchandise trade was up 5.7% year-on-year in the first quarter of 2021, the largest jump since the 5.8% rise in third quarter of 2011. The latest barometer reading suggests that goods trade will see an even larger year-on-year increase in the second quarter once trade volume data for that period are available.

Also read: WTO goods trade barometer reveals strength of trade recovery, depth of COVID-19 shock

The Goods Trade Barometer is a composite leading indicator providing real-time information on the trajectory of merchandise trade relative to recent trends ahead of conventional trade volume statistics. The latest barometer reading of 110.4 is the highest on record since the indicator was first released in July 2016, and up more than 20 points year-on-year.

The rise in the barometer reflects both the strength of current trade expansion and the depth of the pandemic-induced shock in 2020. It is notable that, while still well above trend, the index has started to rise at a decreasing rate, which could presage a peaking of upward momentum in trade.

All of the barometer’s component indices were above trend in the latest month, illustrating the broad-based nature of the recovery. Indices for air freight (114.0), container shipping (110.8) and raw materials (104.7) in particular continued to rise, signalling faster than average trade growth.

The automotive products index (106.6) also rose despite the fact that car production and sales fell in July in some countries due to a shortage of semiconductors (the rise can be explained by smoothing of the underlying data). This shortage is also reflected in a small decline in the electronic components index (112.4).

The forward-looking new export orders index (109.3) has slowed more definitively, providing a further indication that the pace of recovery is likely to decelerate in the near term.

The rise in the air freight index reflects a rebound in air transport due to the easing pandemic-related travel restrictions in some (mainly developed) countries. The index could turn down again suddenly if the spread of COVID-19 variants forces the re-imposition of restrictions.

The outlook for world trade continues to be overshadowed by downside risks, including regional disparities, continued weakness in services trade, and lagging vaccination timetables, particularly in poor countries. COVID-19 continues to pose the greatest threat to the outlook for trade, as new waves of infection could easily undermine the recovery.

– global bihari bureau