FDI Rises 14% in 2025 as Finance Drives Uneven Rebound

Developed Economies Lead FDI Rebound as Poorer Nations Lag

UNCTAD Flags Weak Real Investment Despite FDI Recovery

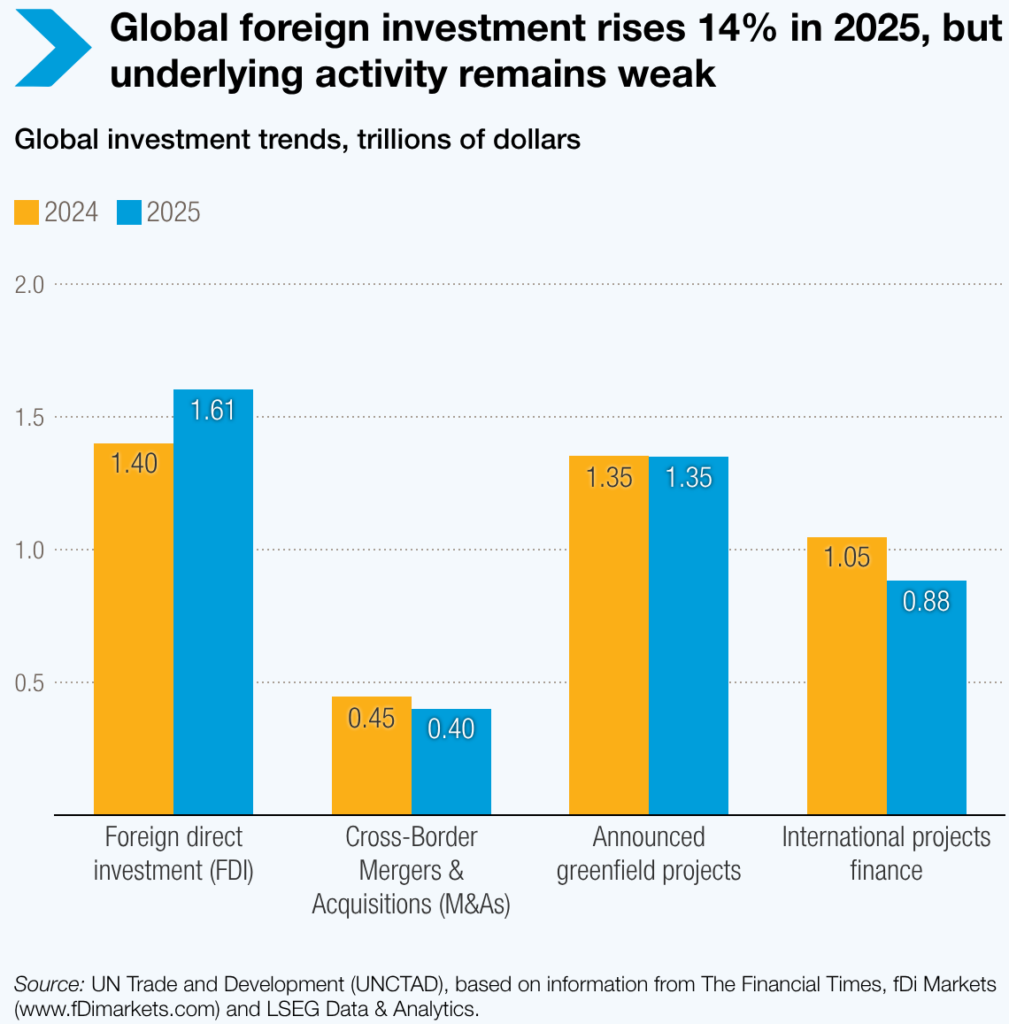

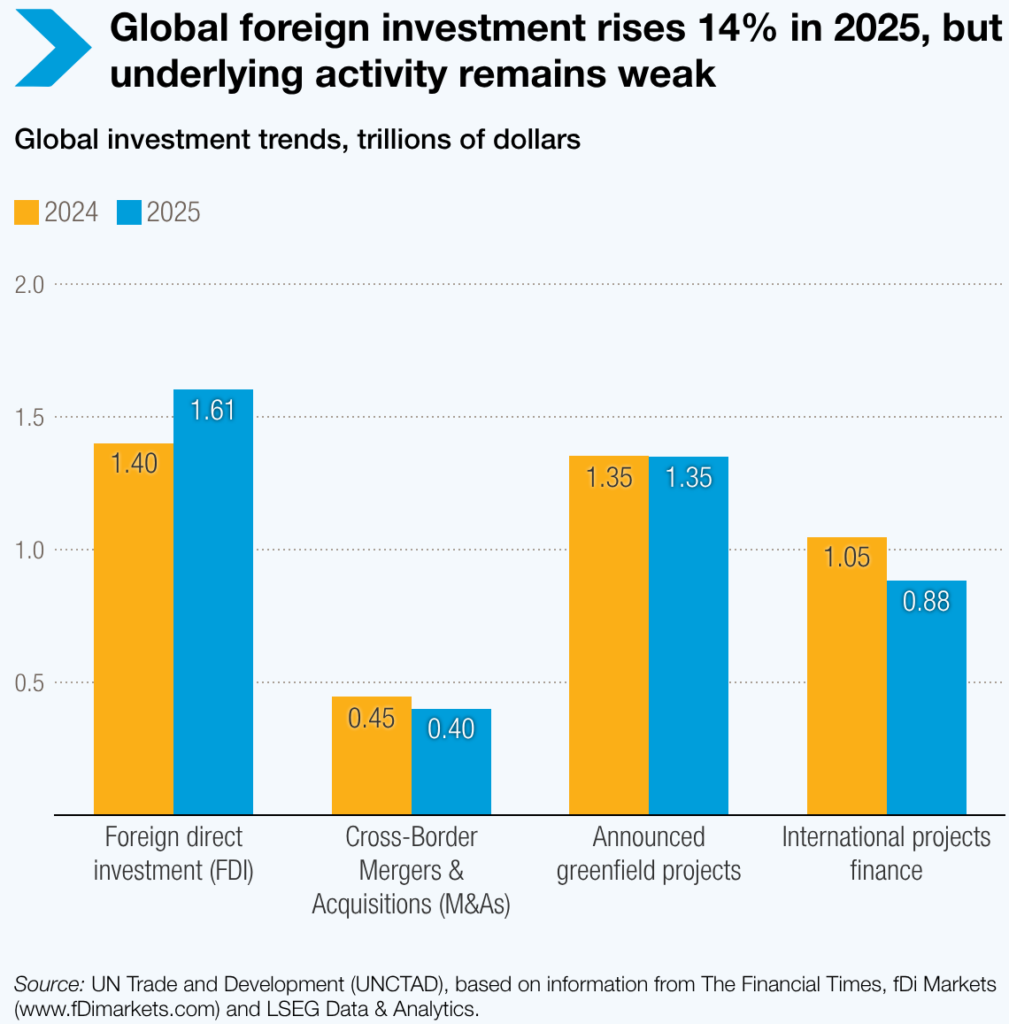

Geneva: Global foreign direct investment rebounded in 2025 after two consecutive weak years, rising 14 per cent to an estimated $1.6 trillion, according to the latest Global Investment Trends Monitor released by UN Trade and Development (UNCTAD). The recovery, however, was driven largely by financial flows through global hubs rather than a broad-based revival in productive investment, leaving underlying activity critical for development fragile.

UNCTAD said more than $140 billion of the increase came from higher flows through global financial centres. Excluding these conduit flows, global FDI rose by only about 5 per cent, underscoring the limited nature of the rebound. The agency noted that investor sentiment indicators remained weak throughout the year, reflecting continued caution amid geopolitical tensions, policy uncertainty and economic fragmentation.

International mergers and acquisitions declined by 10 per cent in value in 2025, while international project finance fell for a fourth consecutive year, dropping 16 per cent in value and 12 per cent in deal numbers to levels last seen in 2019. Announced greenfield investment projects also fell by 16 per cent, despite elevated total values driven by a small number of mega-projects. Taken together, the data point to a recovery led more by financial transactions than by new investment in productive capacity.

The rebound was uneven across regions. FDI flows to developed economies surged by 43 per cent to $728 billion, propelled by Europe and global financial hubs. The European Union recorded a 56 per cent increase, supported by large cross-border acquisitions and a recovery in major economies including Germany, France and Italy. By contrast, flows to developing economies declined by 2 per cent to $877 billion, although they still accounted for 55 per cent of global FDI. Lower-income countries were hit hardest, with around three-quarters of the least developed countries experiencing stagnant or falling inflows.

UNCTAD said global investment patterns are becoming increasingly concentrated in a small number of capital-intensive sectors. Data centres accounted for more than one-fifth of global greenfield project values in 2025, with announced investments exceeding $270 billion, driven by rising demand for artificial intelligence infrastructure and digital networks. Semiconductor project values rose 35 per cent, even as project numbers fell sharply in tariff-exposed sectors such as textiles, electronics and machinery.

Major data centre investments were concentrated in a limited number of host countries, led by France, the United States and the Republic of Korea. Emerging markets, including Brazil, India, Thailand and Malaysia, also attracted sizeable projects, highlighting selective opportunities amid a broader slowdown in manufacturing-related investment.

International infrastructure investment remained under pressure, falling by 10 per cent in 2025. The decline was attributed mainly to a pullback in renewable energy projects, as investors reassessed revenue risks and regulatory uncertainty. While domestic investors increasingly stepped in to fill part of the gap, UNCTAD warned that this shift could widen investment shortfalls in countries that rely heavily on international finance for large-scale infrastructure and development projects.

Looking ahead, UNCTAD said global FDI could increase modestly in 2026 if financing conditions continue to ease and cross-border mergers and acquisitions recover. However, it cautioned that real investment activity is likely to remain subdued unless confidence improves and policy uncertainty recedes. The agency said attention is now turning to how global policy dialogue can help redirect capital toward more productive uses, noting that the World Investment Forum will convene in Doha in October 2026 under the theme “Investing in the Future”.

Without concerted action to revive productive investment, UNCTAD warned, global FDI risks becoming increasingly concentrated in a few regions and sectors, limiting its potential contribution to sustainable development.

– global bihari bureau