Food Prices Dip as Cereal Production Soars

Low-Carbon Ammonia Boosts Fertiliser Future

Geneva: Global food commodity prices experienced a slight decline in September, primarily due to falling sugar and dairy prices, though meat prices reached a record high, according to the Food and Agriculture Organization of the United Nations (FAO). Concurrently, FAO’s latest forecasts project a significant increase in global cereal production for 2025, driven by robust wheat, maize, and rice outputs, signalling strong supply prospects.

The Agricultural Market Information System (AMIS) complements this outlook with reports of favourable crop conditions and highlights the potential of low-carbon ammonia to advance sustainable fertiliser production, supporting global food security amidst evolving market dynamics.

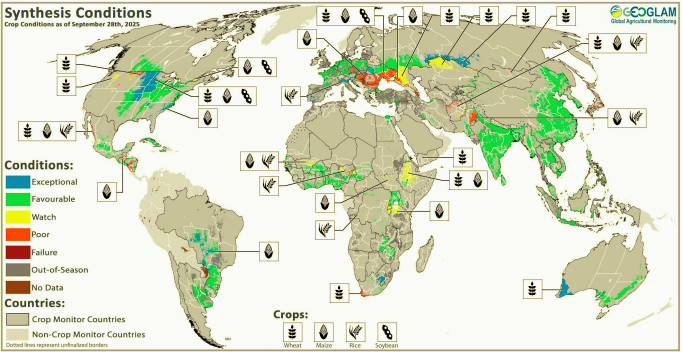

Crop conditions around the world

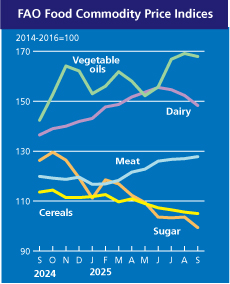

The FAO Food Price Index, which tracks monthly changes in international prices of a basket of globally traded food commodities, averaged 128.8 points in September, down slightly from a revised 129.7 points in August. This represents a 3.4 per cent increase from September 2024 but remains 19.6 per cent below its peak in March 2022. A 4.1 per cent drop led the decline in the FAO Sugar Price Index, which fell to 99.4 points, its lowest since March 2021, driven by higher-than-expected sugar production in Brazil and favourable harvest prospects in India and Thailand due to ample monsoon rains and expanded plantings.

The FAO Dairy Price Index decreased by 2.6 per cent to 148.3 points, with butter prices falling 7.0 per cent due to reduced ice cream demand in the Northern Hemisphere and higher production expectations in Oceania. Milk powder prices also declined due to softer demand from key importers and increased export competition, while cheese prices saw a marginal drop. The FAO Cereal Price Index declined by 0.6 percentage points to 105.0 points, with wheat prices falling for the third consecutive month due to subdued international demand and large harvests in key producers such as the Russian Federation, Europe, and North America. Maize prices dropped, supported by forecasts of abundant supplies in Brazil and the United States, as well as Argentina’s temporary suspension of grain export taxes.

The FAO Dairy Price Index decreased by 2.6 per cent to 148.3 points, with butter prices falling 7.0 per cent due to reduced ice cream demand in the Northern Hemisphere and higher production expectations in Oceania. Milk powder prices also declined due to softer demand from key importers and increased export competition, while cheese prices saw a marginal drop. The FAO Cereal Price Index declined by 0.6 percentage points to 105.0 points, with wheat prices falling for the third consecutive month due to subdued international demand and large harvests in key producers such as the Russian Federation, Europe, and North America. Maize prices dropped, supported by forecasts of abundant supplies in Brazil and the United States, as well as Argentina’s temporary suspension of grain export taxes.

The FAO All Rice Price Index decreased by 0.5 per cent, reflecting reduced purchase orders from the Philippines and African countries amid ample exportable supplies. The FAO Vegetable Oil Price Index declined by 0.7 per cent to 167.9 points, driven by lower palm and soybean oil prices, with Malaysia’s high palm oil stocks and Argentina’s elevated soybean oil supplies outweighing rises in sunflower and rapeseed oil prices due to supply tightness in the Black Sea region and Europe. In contrast, the FAO Meat Price Index rose by 0.7 per cent to a record 127.8 points, up 6.6 per cent from a year ago, fueled by strong U.S. demand for bovine meat, which hit an all-time high, and higher ovine meat prices due to limited supply from Oceania. Pig and poultry meat prices remained stable, with Brazilian pig meat demand offsetting reduced purchases by China.

FAO’s Cereal Supply and Demand Brief projects global cereal production in 2025 at 2,971 million tonnes, a 3.8 per cent increase from 2024, marking the largest annual growth since 2013. Wheat production is forecast at 809.7 million tonnes, up 1.3 per cent from 2024, with upward revisions for Australia, the European Union, and the Russian Federation due to improved yields. Maize production is expected to reach 1,605 million tonnes, a 6.5 per cent increase, driven by higher forecasts in Brazil and the United States, where output is projected to hit an all-time high of 427.1 million tonnes, accounting for one-third of global production. Rice production is anticipated to reach a record 556.4 million tonnes, up 1.2 per cent, with India’s strong Kharif crop plantings outweighing a downgrade in Pakistan due to floods.

FAO’s Cereal Supply and Demand Brief projects global cereal production in 2025 at 2,971 million tonnes, a 3.8 per cent increase from 2024, marking the largest annual growth since 2013. Wheat production is forecast at 809.7 million tonnes, up 1.3 per cent from 2024, with upward revisions for Australia, the European Union, and the Russian Federation due to improved yields. Maize production is expected to reach 1,605 million tonnes, a 6.5 per cent increase, driven by higher forecasts in Brazil and the United States, where output is projected to hit an all-time high of 427.1 million tonnes, accounting for one-third of global production. Rice production is anticipated to reach a record 556.4 million tonnes, up 1.2 per cent, with India’s strong Kharif crop plantings outweighing a downgrade in Pakistan due to floods.

Global cereal utilisation is forecast at 2,930 million tonnes, a record high, with increased use for animal feed in Brazil, the United States, Egypt, and Mexico, and human consumption rising with population growth. Cereal stocks are expected to reach 900.2 million tonnes by the close of the 2026 season, with rice reserves potentially hitting a record high, driven by accumulations in India, Brazil, and the United States. The global cereal stocks-to-use ratio is projected to remain stable at 30.6 per cent, indicating comfortable supply prospects. International cereal trade is forecast to grow by 2.5 per cent to 497.1 million tonnes, with wheat trade rising 4.9 per cent to 202.1 million tonnes, driven by exports from Australia and the United States, while rice trade is expected to decline by 1.8 per cent to 60.1 million tonnes due to lower demand from Asian and African countries following strong local harvests.

The AMIS Market Monitor reports generally favourable crop conditions globally. In the Northern Hemisphere, spring wheat harvesting is wrapping up with above-average yields in the Russian Federation, Canada, and the United States, though dry conditions affect winter wheat sowing in Ukraine. In the Southern Hemisphere, Australia and Argentina report promising wheat crop prospects. Maize harvesting is advancing in the United States and Brazil with exceptional yields, though drought in southeastern Europe has reduced output in Bulgaria, Hungary, and Romania. Rice conditions are favourable in China, India, and Southeast Asia, despite localised flooding in Thailand and Vietnam. Soybean harvests in the United States and China are progressing well, with Brazil beginning sowing under favourable conditions. The Monitor also features a review of low-carbon ammonia production for fertilisers, critical for global agriculture. Ammonia production, which accounts for 1.3 per cent of global CO₂ emissions, is energy-intensive, requiring 32–36 million British thermal units of natural gas per tonne. Green ammonia, produced using renewable energy, and blue ammonia, incorporating carbon capture, offer sustainable alternatives, with pilot projects underway in countries like the United States and Near East nations. However, high costs and infrastructure needs pose challenges to scaling these technologies.

Market developments reflect a mix of supply abundance and policy-driven shifts. Argentina’s temporary suspension of export taxes on maize, soybeans, and wheat, which ended after reaching a $7 billion export threshold, spurred heavy sales, pressuring global soybean and maize prices. Trade tensions, including China’s tariffs on EU pig meat and the absence of U.S. soybean sales to China, are reshaping trade flows.

Fertiliser prices eased in September due to reduced demand in India and increased Chinese exports, though affordability concerns persist for phosphorus and potassium fertilisers. Ocean freight markets saw a 6 per cent rise in the Baltic Dry Index, driven by demand for minerals and grains shipments, with higher freight costs noted on routes from Europe and the United States. These dynamics suggest a well-supplied global market, but trade disruptions and high input costs could influence future planting decisions.

– global bihari bureau