Infrastructure finance is up due to recovery stimulus packages, but greenfield investment activity remains weak across industrial sectors.

Geneva: Global foreign direct investment (FDI) flows showed a strong rebound in 2021, up 77% to an estimated $1.65 trillion, from $929 billion in 2020, surpassing their pre-COVID-19 level, according to UNCTAD’s Investment Trends Monitor published on 19 January.

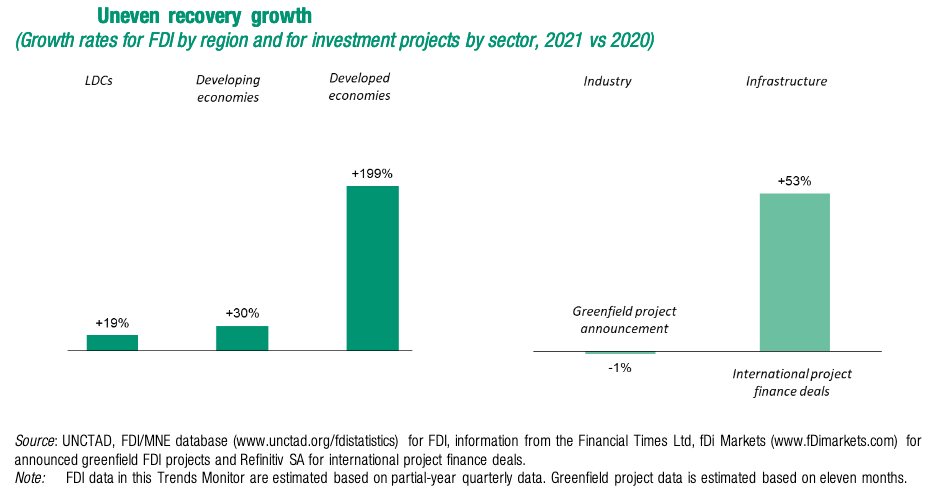

Developed economies saw the biggest rise by far, with FDI reaching an estimated $777 billion in 2021 – three times the exceptionally low level in 2020, the report shows. But recovery in development sectors remains fragile.

FDI flows in developing economies increased by 30% to nearly $870 billion, with a growth acceleration in East and South-East Asia (+20%), a recovery to near pre-pandemic levels in Latin America and the Caribbean, and an uptick in West Asia.

Of the total increase in global FDI flows in 2021 ($718 billion), more than $500 billion, or almost three quarters, was recorded in developed economies. Developing economies, especially least developed countries (LDCs), saw more modest recovery growth.

Investor confidence was strong in infrastructure sectors (see figure), supported by favourable long-term financing conditions, recovery stimulus packages, and overseas investment programmes. International project finance deals were up 53% in number and 91% in value, with sizeable increases in most high-income regions and in Asia and Latin America and the Caribbean.

In contrast, investor confidence in industry and global value chains remains weak. Greenfield investment project announcements were practically flat (-1% in number, +7% in value). The number of new projects in GVC-intensive industries (e.g. electronics) fell further.

Other trends by sector:

- Greenfield investment activity remains 30% below pre-pandemic levels on average across industrial sectors. Only information and communication (digital sector) has fully recovered.

- Project finance in infrastructure now exceeds pre-pandemic levels across most sectors. Project numbers are up most in renewable energy and industrial real estate.

- The boom in cross-border M&As is most pronounced in services. The number of deals in information and communication increased by more than 50% to a quarter of the total.

Trends in selected economies:

- FDI in the United States – the largest host economy – increased by 114% to $323 billion; cross-border M&As almost tripled in value to $285 billion. Inflows in the United States more than doubled, with the increase entirely accounted for by a surge in cross-border mergers and acquisitions (M&As).

- FDI in the European Union was up 8%; flows in the largest economies remained well below pre-pandemic levels. In Europe, more than 80% of the increase in flows was due to large swings in conduit economies.

- China saw a record $179 billion of inflows – a 20% increase – driven by strong services FDI.

- Brazil saw FDI double to $58 billion from a low level in 2020; inflows remained just below pre-pandemic levels.

- ASEAN resumed its role as an engine of growth for FDI in Asia and globally, with inflows up 35% and increases across most members.

- Flows to India were 26% lower, mainly because large M&A deals recorded in 2020 were not repeated.

- Inflows to Saudi Arabia quadrupled to $23 billion, in part due to an increase in cross-border M&As.

- Inflows in Africa also rose. Most recipients across the continent saw a moderate rise in FDI; the total for the region more than doubled, inflated by a single intra-firm financial transaction in South Africa in the second half of 2021. Flows to South Africa jumped to $41 billion (from $3 billion in 2020) due to the $46 billion share swap between the South African multinational Naspers and its Dutch-listed investment unit Prosus.

“Recovery of investment flows to developing countries is encouraging, but stagnation of new investment in least developed countries in industries important for productive capacities, and key SDG sectors – such as electricity, food, or health – is a major cause for concern,” said UNCTAD Secretary-General Rebeca Grynspan.

– global bihari bureau