WTO: India Among G20 Members Recasting Trade Policies

Geneva: India figures prominently in the latest monitoring exercise of the World Trade Organization (WTO), which records an exceptional surge in new tariff actions and other trade-related measures among G20 economies between mid-October 2024 and mid-October 2025.

India’s notifications form part of a wider set of policy adjustments that fall within the WTO’s category of “other trade and trade-related actions”, which covers tariff revisions, licensing requirements, technical regulations, conformity assessments and related instruments shaping merchandise flows.

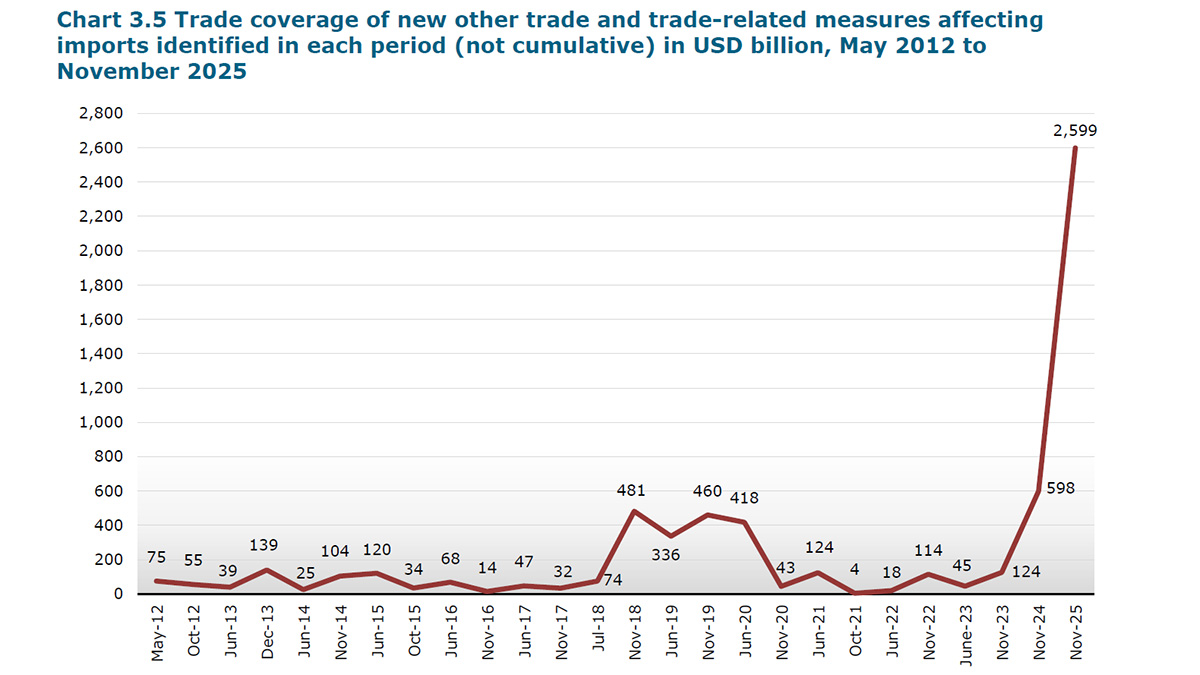

Like several large economies, India introduced at least one such measure during the period, contributing to a collective expansion that raised the value of affected G20 merchandise imports to USD 2,599 billion—more than four times the previous year’s USD 599 billion—and equivalent to 14.3% of total G20 imports.

The WTO attributes this surge primarily to tariff actions linked to national and economic security objectives, a pattern visible across both advanced and emerging G20 economies, including India, the United States, China, the European Union, Brazil and others.

India’s position in the report reflects the broader shift underway across the G20, where the cumulative share of imports affected by existing and new “other trade and trade-related measures” rose to 22.0%—USD 4,015 billion—up sharply from 12.9% a year earlier. This translates to 16.9% of world imports now falling under measures classified within this category. The WTO calls this the steepest single-period rise since monitoring began in 2009.

The adjustments across the G20 indicate a transition in trade policy thinking, marked not by a broad retreat from openness but by targeted recalibration in sectors tied to industrial resilience, technological capability and strategic inputs. India’s measures tracked this shift, aligning with the efforts of many members to update regulatory frameworks in response to shifting supply chains, climate-linked transitions and geopolitical pressures.

Alongside these restrictive measures, India also appeared among the G20 economies that introduced trade-facilitating steps. Across the group, 184 new facilitation measures were implemented, easing trade in goods worth USD 2,055 billion—almost double the USD 1,070 billion recorded in the prior period. These included customs simplifications, streamlined licensing procedures, adjustments to standards and reduced duties on selected imports. The WTO notes that this dual movement—sharp increases in restrictions combined with substantial liberalisation—has become characteristic of G20 policymaking, reflecting simultaneous demands for security, competitiveness and supply-chain diversification.

India was also active in WTO committees, where members repeatedly sought clarification from one another on new trade-related actions. Most concerns raised in committees pertained to policy adjustments by G20 members. India engaged alongside other major traders on matters such as technical barriers to trade, sanitary and phytosanitary requirements, agricultural market access, digital regulations and conformity-assessment procedures. The WTO stresses that these committee discussions helped manage differences at a time when regulatory activity accelerated across the G20.

Services policy developments formed another layer of the report. G20 members introduced 52 new measures in services, more than two-thirds of which were trade-facilitating. Approximately 43% applied across multiple sectors, particularly affecting services supplied through commercial presence (Mode 3) and the movement of professionals (Mode 4). Around 10% targeted digital, telecommunications and Internet-enabled services. India’s adjustments appeared within this shared pattern, reflecting the rebalancing of digital-market regulation and cross-border professional mobility across the G20.

Investment policy changes captured by the WTO, the Organisation for Economic Co-operation and Development and the United Nations Conference on Trade and Development depict a global environment marked by heightened screening of sensitive technologies and data-related infrastructure. Australia, Canada, the European Union, Japan and the United States were among those strengthening scrutiny frameworks. India’s updates placed it within this landscape of strategic domestic capability-building, mirroring the broader transition from purely financial incentive schemes toward non-financial interventions with long-term structural aims.

Trade remedy actions remained a significant part of the G20’s policy toolkit. The group initiated an average of 28.5 investigations per month—slightly fewer than in 2024 but close to 2020 levels—with anti-dumping measures accounting for 55.2% of all actions. Terminations of existing measures remained low at 9.3 per month, adding to the accumulated stock of active remedies. India, together with economies such as the United States, the European Union, China, Turkey, Brazil and Indonesia, featured among initiators or respondents, reflecting the global distribution of these instruments rather than concentration in any single member.

The WTO report situates all these developments within a broader macroeconomic environment shaped by reconfigured supply chains, technological realignment and patchy global growth. WTO economists project world merchandise trade to grow by 2.4% in 2025 before slowing to 0.5% in 2026. Much of the stronger-than-expected performance in early 2025 was driven by import front-loading, elevated demand for artificial intelligence-related products and continued resilience among developing economies. India joined China, Indonesia, Mexico and others in recording a sturdier trade performance during this period relative to several advanced economies.

General and economic support measures expanded significantly across the G20, particularly in renewable energy, digital infrastructure, agriculture and green technologies. These interventions increasingly targeted long-term structural goals such as energy transition, technological upgrading and climate resilience. India’s support measures were consistent with this shift, aligning with similar sectoral priorities pursued by the European Union, Japan, South Korea and the United States.

The report also notes a modest rise in dispute-settlement activity, with all new requests for consultations involving measures originating in G20 economies. India remained one of the active participants in this system, reflecting the scale and diversification of its global trade engagement. The WTO underscores that the prominence of G20-origin disputes is unsurprising given that the group accounts for around 80% of world trade.

Across all dimensions of the monitoring exercise, the report depicts a global trading system undergoing rapid restructuring. India’s trade, services and investment measures are positioned naturally within this landscape of strategic recalibration across the G20. While the period witnessed record increases in new restrictions, it also saw a large expansion in measures that reduce trade barriers and lower costs.

WTO Director-General Ngozi Okonjo-Iweala characterised the findings as evidence of a system under strain but still functioning, noting that despite heightened pressures, G20 economies generally refrained from retaliation and relied instead on committee engagement and bilateral dialogue. The report situates India within this collective trend, reflecting the extent to which its policy trajectory aligns with broader shifts shaping G20 trade relations.

– global bihari bureau