Photovoltaic cells

Global Value Chains

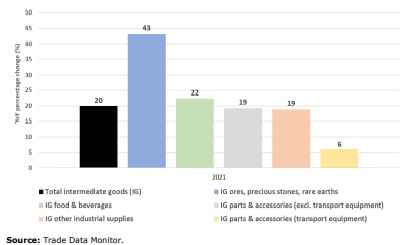

Geneva: World exports of intermediate goods (IG), such as parts and components, rose by 20% year-on-year in the first quarter of 2021 according to a new WTO quarterly report released last night (IST) to help track the health of global supply chains. The increase sustains the upward trend in IG exports following the sharp decline in the second quarter of 2020 when the global spread of the COVID-19 crisis was in its early stages.

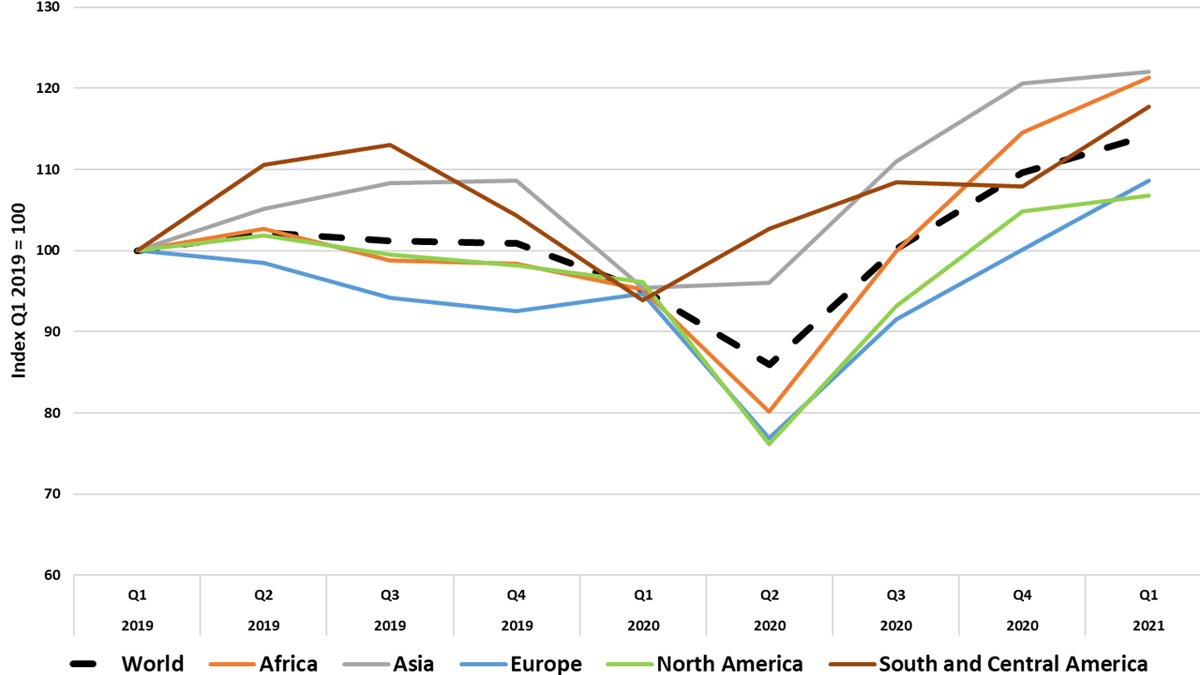

Exports of intermediate goods by region, 2019Q1-2021Q1

Source: Trade Data Monitor (98 reporting economies, including estimates for Africa).

Asia recorded the highest growth in exports of intermediate goods in the first quarter (28 per cent) due to a 41 per cent increase in Chinese exports of industrial intermediate goods, mainly parts for information communication technology equipment and photovoltaic cells.

The most resilient supply chains in the first quarter were for ores, precious stones and rare earths, with exports increasing by 43 per cent in the first quarter, and for food and beverages (up 22 per cent). In contrast, exports of transport parts and accessories posted the weakest recovery at 6 per cent following steep declines in 2020 as the pandemic affected both demand for and production of automotives.

Platinum group metals (PGMs), a commodity used in electronic components, catalytic converters to treat automobile exhaust emissions, and other industries accounted for around 2% of ores, precious stones and rare earths exported in 2020 and are strategic inputs for many industries.

Top IG exporters, Q1 2021

China was the main IG supplier, with exports increasing by 41 per cent YoY. The large increase in Australia’s IG exports (61 per cent) was mainly from iron ore concentrates used by the steel industry which represented nearly 60 per cent of the country’s IG exports. Italy saw an increase in IG exports of 18 per cent, mainly due to shipments of automotive parts and precious metals (gold, platinum group metals) to Germany and Switzerland.

Top IG importers, Q1 2021

China was the main purchaser of IGs. Its imports grew by 37 per cent, reflecting the dynamic recovery of the economy. India was a major IG importer (49 per cent increase), due essentially to shipments of electrical and electronic parts from Chinese companies as well as raw diamonds and gold materials from Switzerland and the United Arab Emirates. Italy, the first country in Europe to be hit by the health crisis, had the strongest European growth in IG imports (20 per cent), especially of diagnostic and laboratory reagents from European companies.

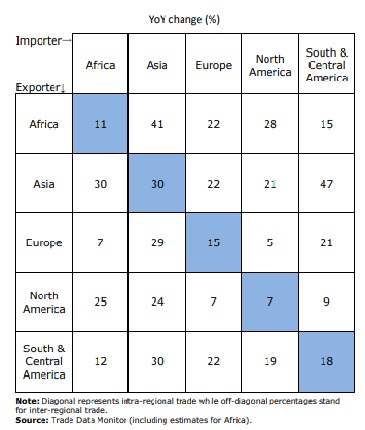

Inter- and intra-regional IG trade, Q1 2021

Totaling US$ 635 billion, Asia’s intra-regional trade was the highest regional trade flow, growing by 30 per cent YoY in Q1 2021. Africa and South and Central America increased markedly their exports of inputs to Asia (i.e. soybeans, other food ingredients, ores), by 41 per cent and 30 per cent, respectively.

Asian growth in exports to Africa (up 30 per cent) was mainly due to increases in palm oil, woven fabrics, automotive parts and accessories as well as vaccines.

While the 47 per cent rise with South and Central America was borne by shipments of photovoltaic cells as well as gear boxes for motor vehicles.

A substantial increase (24 per cent) in North American exports to Asia was mainly due to agricultural inputs, likely related to the US-China Phase One deal (i.e. soybeans, corn, cotton), processors and integrated circuits.

Although with low levels of trade, African industries reinforced their participation in supply chains by increasing IG exports to all regions. At 11 per cent, however, growth in intra-regional trade remained weak.

Trade statistics on intermediate goods reflect the international exchanges of parts, components, accessories used to produce final products and serve as an indicator of the activity in supply chains.

– global bihari bureau