UNCTAD Reports Surge in South–South Trade

Manufacturing Powers 2025 Trade Boom

Geneva: In a world shadowed by geopolitical rifts and shifting economic policies, global trade has defied the odds. The latest Global Trade Update (October 2025) by the UN Conference on Trade and Development (UNCTAD) reveals that international commerce expanded by nearly USD 500 billion in the first half of 2025, a 2.5 per cent quarter-on-quarter rise that signals remarkable resilience amid uncertainty.

Driven largely by developing economies and buoyed by robust South–South trade, the expansion positioned 2025 to surpass last year’s record levels in global trade value — provided no major shocks disrupt the final quarter. Manufacturing continues to anchor this growth, with electronics, hybrid and electric vehicles leading the charge.

Momentum Amid Turbulence

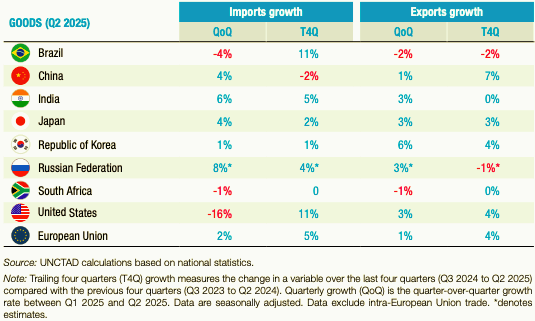

Despite policy turbulence and ongoing conflicts across key regions, global trade in both goods and services surged in the second quarter (Q2) of 2025. Goods trade growth edged up from about 2 per cent in Q1 to 2.5 per cent, while services, which had contracted earlier in the year, rebounded sharply.

UNCTAD’s nowcast points to continued strength into the third quarter (Q3), projecting goods to expand by about 2.5 per cent and services by nearly 4 per cent quarter over quarter. On a rolling annual basis, growth remains robust—around 5 per cent for goods and 6 per cent for services.

This sustained upward trajectory reflects what UNCTAD analysts describe as a “measured yet determined rebound” in global trade — powered not by a single bloc but by diversifying partnerships among emerging economies.

Developing Economies Take the Lead

The report identifies developing nations as the principal drivers of the 2025 trade surge. Imports in these economies grew by about 6 per cent in Q2 compared to the previous quarter, while developed countries’ imports remained flat. Exports mirrored this pattern, with developing economies outperforming developed ones.

South–South trade — exchanges among developing nations — continued to show above-average growth during the 12-month period ending in June 2025. Although performance varied by region, East Asian and African economies recorded especially strong merchandise trade, underpinned by rising intra-regional activity.

In contrast, North America saw a contraction in imports, following the front-loading of tariffs earlier in the year as part of the United States’ evolving trade policy.

US imports strongly declined in Q2 2025; Major Asian economies overperformed in the same period

Manufacturing Anchors the Expansion

Manufacturing has been the powerhouse of this global recovery. In Q2 2025, the sector registered significant gains, led by electronics, electrical and non-electrical machinery, and automotive products. The ongoing transition to hybrid and electric vehicles has invigorated the automotive trade, while sustained demand for AI-driven electronics has boosted the sector’s momentum.

Over the past four quarters, manufacturing trade expanded by roughly 9 per cent, even as certain industries such as iron and steel saw sharp quarter-on-quarter declines following earlier surges.

Conversely, natural resource-based trade fell, primarily due to lower fossil fuel prices. Agricultural trade, however, recorded strong growth, notably in coffee exports, which rose on the back of higher global prices.

The Green and Digital Divide

Trade in renewable energy products presented a mixed picture. The value of fossil fuel trade declined sharply amid falling prices, while trade in wind- and battery-related goods expanded. Solar-related products and critical minerals saw notable declines, driven by a fall in solar cell prices and policy shifts in key producer countries.

Meanwhile, electronics trade outperformed manufacturing averages, buoyed by sustained demand for digital technologies and artificial intelligence systems, even as semiconductor trade remained below the sector’s overall pace due to continuing export restrictions and supply chain controls.

Inflation and Price Dynamics

Prices for traded goods registered a modest uptick in Q2 2025, with preliminary estimates pointing to a significant rise in Q3. This shift suggests that while the increase in trade value earlier in the year was driven largely by higher volumes, price effects will increasingly shape trade growth through the latter half of the year.

Trade inflation, which had eased during the first half, is now projected to climb in Q3, adding a new layer of complexity for policymakers navigating between growth and stability.

The US Slowdown and Policy Uncertainty

The report paints a cautious picture of the United States’ trade outlook. While other regions expanded, US imports dropped significantly in Q2, pulling down the global average. Despite concluding some trade deals, Washington’s negotiations with key partners remain unresolved, and sector-specific tariffs loom as a potential risk.

This uncertainty, UNCTAD warns, could intensify volatility in global trade flows. Yet so far, the impact of US policy shifts has been “relatively contained”, with developing economies continuing to exhibit strong commitment to open trade.

Still, forward indicators offer mixed signals: China’s Purchasing Managers’ Index (PMI) dipped below 50 in August, hinting at contraction, while the US PMI remained above 50, signalling expansion. Shipping indicators also diverged — the Shanghai Containerised Freight Index fell, whereas the Baltic Dry Index climbed, reflecting complex dynamics in global logistics.

Regional and Bilateral Trade Patterns

Regional performance in Q2 underscored widening contrasts. East Asia and Africa led in merchandise trade growth, with intra-regional exchanges in both regions showing renewed vigour. The Pacific saw mixed results, with growth on an annual basis but stagnation in the most recent quarter.

Trade imbalances, a recurring concern in global economics, narrowed in Q2 2025 after widening earlier in the year. The correction stemmed largely from shifts in US trade policy and reduced import demand.

Also read: AI Surge Lifts Global Trade in 2025, But 2026 Clouds Loom: WTO

Trade deficits expanded in Japan, India, and the United Kingdom, while China’s trade surplus fell slightly despite a significant reduction in its surplus with the United States. The European Union’s surplus also declined. However, China’s surplus with the EU and Viet Nam grew, demonstrating the uneven nature of these adjustments.

Globally, bilateral imbalances remain elevated, though some have narrowed — notably the United States’ deficits with China and Canada.

The Resilience of Developing Economies

Despite an uncertain geopolitical climate, developing economies have shown remarkable adaptability. East Asia’s robust supply chains, Africa’s strengthening intra-regional links, and the Pacific region’s gradual diversification all underpin a broader pattern of resilience.

UNCTAD attributes much of this stability to the resilience of the multilateral trading system, which, despite its flaws, has held together through turbulence. “Cooperation among developing countries appears to be strengthening,” the report notes, potentially translating into lower policy uncertainty and higher trade growth in the near term.

Friendshoring, Nearshoring, and the New Geography of Trade

Geoeconomic realignment continues to shape global trade patterns. The once-surging trend of friendshoring — the practice of relocating production to politically aligned countries — remains above historical averages but has stabilised in recent quarters. Similarly, nearshoring and trade concentration trends have levelled off, suggesting that the phase of rapid diversification is easing.

This new equilibrium reflects a delicate balance between geopolitical strategy and economic efficiency, with many nations recalibrating supply chains to ensure both resilience and competitiveness.

Over the past year, China–US trade interdependence has declined only marginally, indicating that complete decoupling remains distant. Instead, the more significant shifts have occurred among secondary partners, as countries across Asia, Africa, and Latin America recalibrate their trade alignments to hedge against volatility.

Balancing Risks and Opportunities

UNCTAD’s analysis underscores that the risks to global trade — from geopolitical tensions to domestic policy shifts — remain tangible. Ongoing conflicts continue to cast long shadows over energy and food security, while protectionist tendencies in response to global overcapacity could disrupt sectors like steel and manufacturing.

At the same time, several positive forces are cushioning global trade from sharper declines: upward revisions to global growth forecasts, potential monetary easing in major economies, and the limited spillover effects of restrictive policies. The resilience of services trade, largely insulated from tariff regimes, is another bright spot expected to sustain global trade momentum.

Trade in Transition

Behind the aggregate figures lies a world in flux — one in which manufacturing-led growth is being reshaped by technological transformation, decarbonisation pressures, and strategic alliances among emerging markets.

In this evolving landscape, developing economies have not only absorbed the shockwaves from advanced economies’ policy pivots but have turned them into opportunities to diversify markets and deepen regional value chains.

The shift towards cleaner technologies, AI-driven manufacturing, and regional integration is slowly rewriting the geography of global commerce. As fossil fuel trade wanes and renewable-related sectors gain traction, the distinction between “green” and “brown” economies becomes increasingly visible in trade data.

The Outlook

Looking ahead, UNCTAD’s projections remain cautiously optimistic. If current trends persist, 2025 could close as a record year for global trade. However, the report warns that persistent geopolitical instability, trade policy uncertainty in the United States, and the resurgence of restrictive measures could test this momentum.

For now, the pulse of global commerce beats strongest in the Global South — in factories assembling electric vehicles, in African ports expanding trade corridors, and in the digital trade networks linking Latin America and Asia.

Even amid uncertainty, one message from UNCTAD’s Global Trade Update rings clear: the future of trade is being shaped not by retreat but by reinvention — a global system adapting, recalibrating, and, against all odds, still growing.

– global bihari bureau