Developing Nations Drown in $921 Billion Interest Deluge

Geneva: A towering wave of debt threatens to sweep away the world’s fragile hopes for sustainable development, the United Nations declared today, issuing a clarion call for sweeping reforms as the 4th International Conference on Financing for Development draws near. Global public debt skyrocketed to $102 trillion in 2024, with developing nations shouldering $31 trillion of that weight and channeling a staggering $921 billion into interest payments alone, strangling budgets and starving essential services like health, education, and climate action, according to UN Trade and Development’s latest “A World of Debt” report.

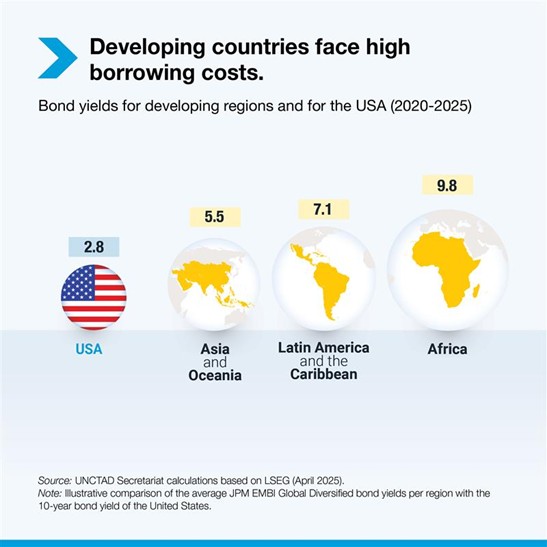

Since 2010, public debt in developing countries has ballooned at twice the speed of wealthier nations. Debt, when manageable, can ignite progress by funding infrastructure and improving lives, but its crushing burden now shackles economies, particularly in the Global South. Developing nations face borrowing costs two to four times higher than those of the United States, a disparity rooted in deep-seated inequalities within the global financial system.

World’s Poorest Pay the Price for a Broken Financial System

In 2023, these countries sent $487 billion to foreign creditors, with half dedicating at least 6.5% of their export earnings to service external public debt. For many, 2023 marked yet another year of net debt outflows, as they paid $25 billion more to lenders than they received in fresh disbursements.

The human cost is profound. In 2024, interest payments consumed $921 billion across developing nations, a 10% surge from the previous year. A record 61 developing economies diverted at least 10% of their government revenues to debt servicing, leaving scant resources for critical investments in health, education, or climate resilience.

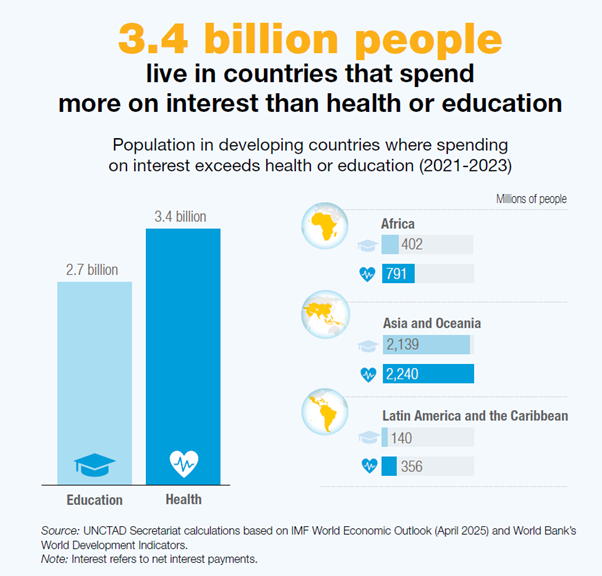

Today, 3.4 billion people live in countries where interest payments eclipse spending on health or education. The debt burden varies sharply across regions: Asia and Oceania account for 24% of global public debt, followed by Latin America and the Caribbean at 5%, and Africa at 2%. Each region faces unique challenges, shaped by the terms of financing and the types of creditors they can access.

High interest rates, sluggish global growth, and mounting uncertainty exacerbate the crisis, making sustainable debt management an uphill battle. Falling investment and shrinking aid flows further imperil the Sustainable Development Goals. The UN’s upcoming conference presents a once-in-a-decade opportunity to overhaul the global financial architecture.

UN Trade and Development presses for bold action: amplifying the voice of developing nations in international economic governance, expanding access to liquidity through greater use of Special Drawing Rights, suspending IMF surcharges, improving emergency financing, and fostering stronger South-South financial cooperation. It also demands a fairer debt resolution mechanism that surpasses the limitations of the G20 Common Framework, alongside more affordable financing, enhanced technical support, and renewed commitment to aid and climate finance pledges.

As the shadow of debt looms ever larger, Geneva’s urgent warning echoes: reform the system now, or the price will be paid in lost futures for billions.

– global bihari bureau