95 Nations Trapped by Commodity Dependence: UNCTAD

Geneva: Two-thirds of developing countries, 95 out of 143, remain heavily reliant on primary commodities like oil, copper, and coffee, leaving their economies vulnerable to global price swings and stifling industrial growth, according to the State of Commodity Dependence 2025 report released by UN Trade and Development (UNCTAD) on July 21, 2025.

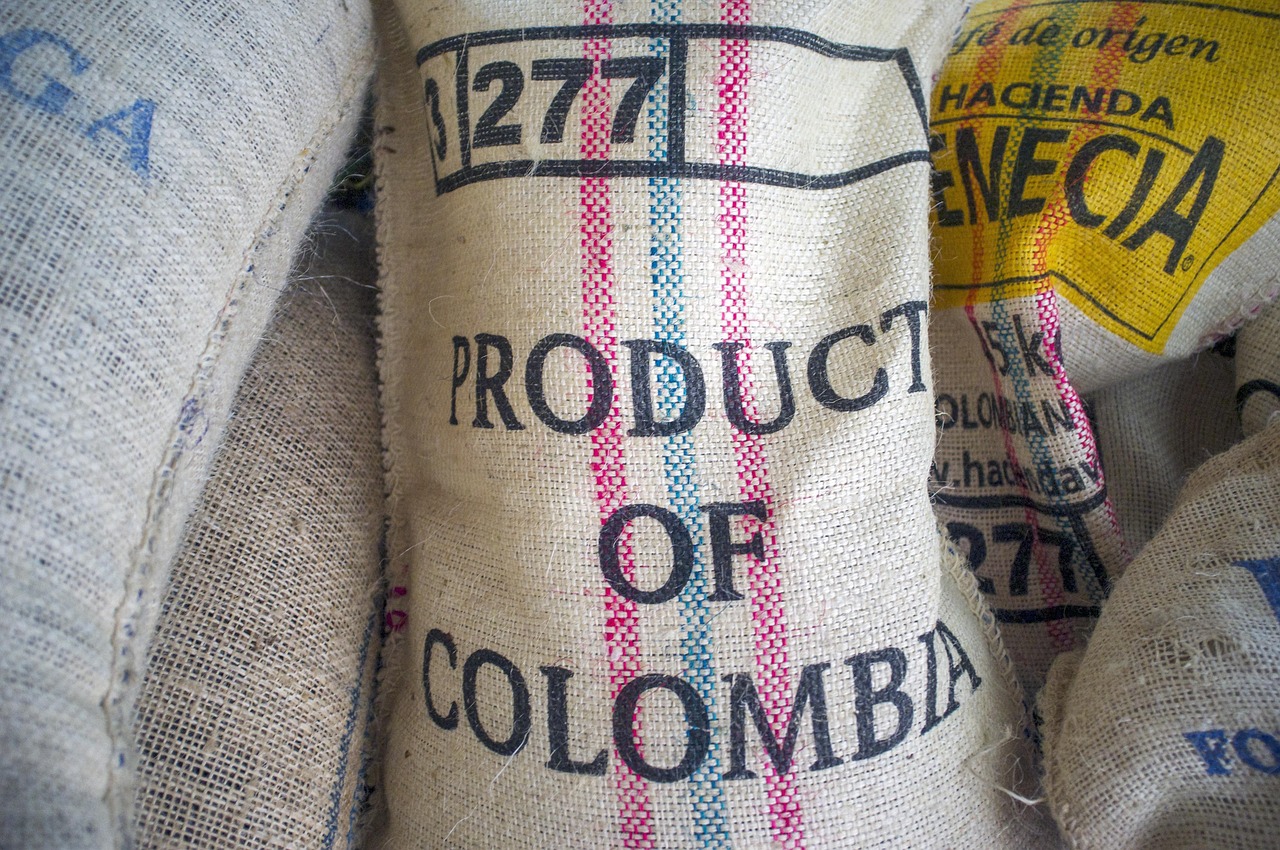

Commodities, spanning energy products like oil and gas, mining outputs such as copper and lithium, and agricultural goods including wheat and coffee, account for one-third of global trade value, with agricultural commodity exports alone surging by 34% to $2.3 trillion between 2021 and 2023. These goods are essential, powering daily life and driving international markets, yet their unprocessed nature poses significant risks for developing nations, exposing them to fiscal instability when global prices fluctuate due to supply chain disruptions, geopolitical tensions, or market shifts. This entrenched dependence, a long-standing global concern, hinders the development of robust industrial sectors and threatens economic stability in resource-rich but structurally vulnerable economies.

The report highlights that over 80% of least developed countries and landlocked developing countries, and approximately 60% of small island developing states, depend heavily on commodities for export earnings, making them particularly susceptible to external shocks. In Middle and Western Africa, the challenge is stark, with most countries deriving over 80% of their export revenues from primary goods. Nigeria and Angola, for instance, rely heavily on oil, while Zambia depends on copper, leaving their economies at the mercy of volatile global markets. Central Asia mirrors this trend, with nations like Kazakhstan and Uzbekistan leaning on energy and mineral exports, such as gas and cotton, while South American countries, including Chile, Peru, and Bolivia, draw significant income from mining products like copper and lithium. These regions’ Wes economies, centred on resource wealth, face heightened risks when prices drop, as seen in past oil slumps or mineral market fluctuations, which can slash government revenues and derail development plans.

UNCTAD warns that without strategic efforts to diversify economies and prioritise value addition—processing raw materials into finished products like refined metals, packaged foods, or advanced technologies—developing countries risk missing opportunities to transform their resources into engines of sustainable growth. Value addition could significantly boost export values and create jobs, yet many nations lack the infrastructure, technology, or financing to process raw coffee beans into roasted blends or lithium into batteries.

The report points to Malaysia’s successful shift from exporting raw palm oil to processed products as a model for others, demonstrating how investment in industrial capacity can enhance economic resilience. However, structural barriers persist, including limited access to capital, technological deficiencies, and global trade policies that favour raw commodity exports over processed goods. In Western Africa, Ghana struggles to move beyond cocoa and gold exports, while Uzbekistan’s cotton industry in Central Asia remains largely unprocessed. In South America, Bolivia’s vast lithium reserves are underutilised for value-added industries like battery production, limiting economic benefits.

The systemic nature of commodity dependence is evident in least developed countries, where over 80% rely on a narrow range of exports, constrained by weak industrial bases and inadequate infrastructure. Landlocked countries like Zambia and Mongolia face additional logistical hurdles in accessing global markets, reinforcing their reliance on raw materials. Small island developing states, such as those in the Pacific, are similarly challenged, with roughly 60% dependent on commodities like fish or agricultural products, compounded by geographic isolation and climate vulnerabilities.

UNCTAD calls for targeted policies to break this cycle, including investments in industrial capacity, skills development, and regional trade agreements to support value-added industries. The report also highlights global trade barriers, such as escalating tariffs on processed goods, which discourage developing countries from moving beyond raw exports, perpetuating their vulnerability.

Global trade dynamics exacerbate these challenges, as commodity-dependent countries often experience slower industrial growth compared to diversified economies like those in East Asia, where value addition has driven development. The 34% growth in agricultural commodity exports between 2021 and 2023 underscores the sector’s potential, but without processing capabilities, much of the economic benefit flows to importing nations.

UNCTAD notes that commodity dependence, rooted in historical patterns of colonial-era resource extraction, continues to shape modern economic vulnerabilities. The report urges developing countries to prioritise innovation and industrial strategies to harness their resource wealth for inclusive growth. It also calls for international support through technical assistance, financing, and fairer trade policies to help vulnerable economies overcome structural barriers. Without these measures, UNCTAD warns, developing countries risk perpetuating economic instability, missing critical opportunities to achieve sustainable development goals and build resilient economies capable of withstanding global market fluctuations.

– global bihari bureau