Tariffs Hit 19.4% of Trade, WTO Warns

Geneva: China’s merchandise exports are projected to rise by 4 to 9 per cent in regions outside North America due to disrupted U.S.-China trade, signalling increased competition, according to the World Trade Organization (WTO) Secretariat’s Trade Monitoring Update of July 3, 2025, incorporating findings from the Global Trade Outlook and Statistics (GTOS) report of April 16, 2025. New tariffs affecting 19.4 per cent of world merchandise imports, covering 2,732.7 billion United States dollars in trade from mid-October 2024 to mid-May 2025, have fueled a volatile trade landscape, tripling the 887.6 billion dollars impacted in the prior 12-month period, the highest coverage since WTO monitoring began in 2009. Amid trade policy uncertainty, geopolitical tensions, and regional conflicts, negotiations like U.S.-China and U.S.-U.K. agreements reflect efforts to ease tensions.

Global merchandise trade faces a projected 0.2 per cent decline in volume for 2025, a sharp reversal from earlier expectations of growth driven by improving macroeconomic conditions, with a 2.5 per cent increase forecast for 2026, nearly three percentage points below prior projections. This downturn stems from tariff surges and trade policy uncertainty (TPU) since early 2025, including U.S. “reciprocal” tariffs and actions by other members. Reinstatement of these tariffs could reduce trade growth by 0.6 percentage points, while spreading TPU could cut an additional 0.8 points, potentially leading to a 1.5 per cent decline in 2025, posing significant risks for least-developed countries (LDCs). U.S. imports from China are expected to fall sharply in textiles, apparel, and electrical equipment, creating opportunities for LDCs to expand exports to the U.S. market. Services trade, impacted by declining goods trade, is projected to grow by 4.0 per cent in 2025 and 4.1 per cent in 2026, below baseline forecasts of 5.1 per cent and 4.8 per cent, due to reduced demand for transport, logistics, and travel driven by lower investment and discretionary spending. Global gross domestic product (GDP) growth is forecasted at 2.2 per cent in 2025, 0.6 percentage points below baseline, with North America facing the largest impact (-1.6 percentage points), followed by Asia (-0.4 points) and South and Central America and the Caribbean (-0.2 points). A broader spread of TPU could double the GDP loss to 1.3 percentage points. Recent policy shifts, including U.S.-China de-escalation and higher U.S. tariffs on steel, aluminium, vehicles, and vehicle parts, have adjusted the 2025 trade growth projection to 0.1 per cent, with a full forecast update planned for October.

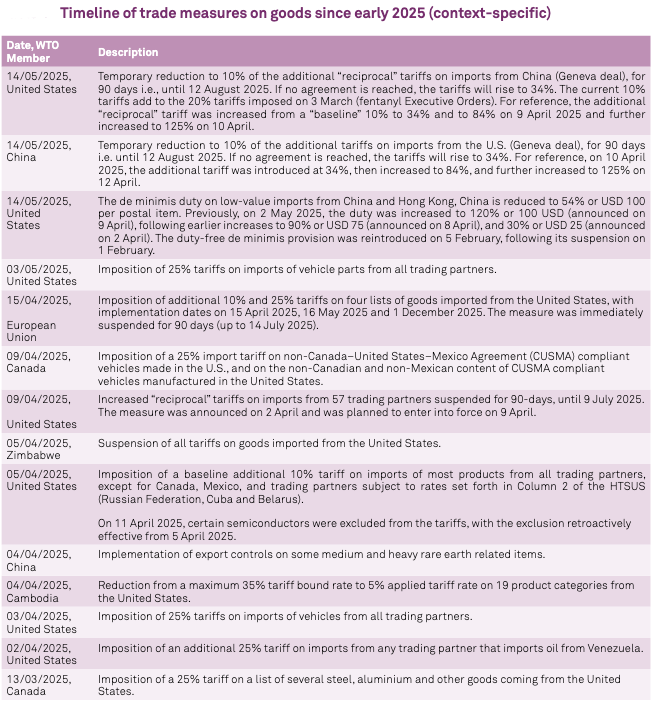

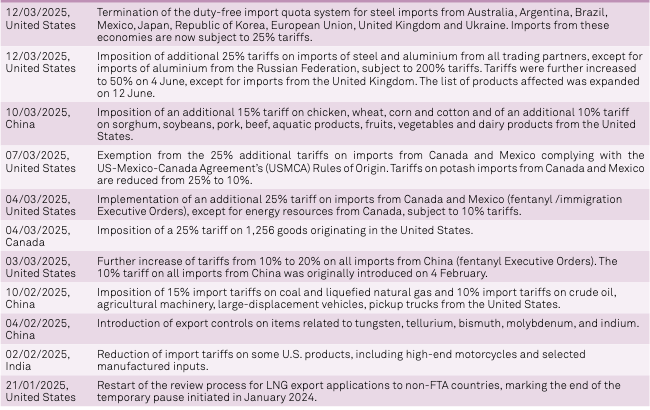

WTO members and observers implemented 644 trade measures on goods during the review period, with trade remedy actions totaling 296 (223 initiations, 73 terminations), primarily anti-dumping measures (79.4 percent of initiations, 82.2 percent of terminations), accounting for 46 percent of measures, the highest number of new investigations in over a decade. These covered 63.9 billion dollars (0.26 per cent of world trade), down from 100.0 billion dollars, while terminations covered 16.3 billion dollars (0.07 per cent), up from 7.6 billion dollars. In 2024, trade remedy initiations peaked at 37.8 per month, surpassing the 2020 high of 36.1, while the review period averaged 31.9 initiations per month, the third highest since 2014, with 90 per cent by G20 economies, and terminations averaged 10.4, the second lowest. Other trade-related measures, numbering 141 (21.9 per cent of total measures), primarily import tariff increases (71.6 per cent), quantitative restrictions, and stricter customs procedures, covered 2,732.7 billion dollars, with 83 per cent (2,261.3 billion dollars) tied to measures introduced in 2025. Import measures accounted for 2,385 billion dollars (9.6 per cent of world imports), and export measures 347.7 billion dollars (1.4 per cent of world exports), with 2025 measures covering 2,235 billion dollars for imports (9.0 per cent) and 26.3 billion dollars for exports (0.11 per cent). The stockpile of import measures since 2009 covers 4,604.1 billion dollars (19.4 percent of world imports), up from 2,959.0 billion dollars (12.5 per cent) in 2024, a 6.9 percentage point increase, while export measures cover 822.9 billion dollars (3.6 percent), up from 811.7 billion dollars (3.5 percent).

Trade-facilitating measures totaled 207 (32.1 percent of total measures), averaging 29.6 per month, the second-highest since 2014, primarily import tariff reductions and relaxed quantitative restrictions, covering 1,038.6 billion dollars (895.9 billion dollars for imports, 3.6 percent of world imports; 142.7 billion dollars for exports, 0.6 percent), down from 1,440.4 billion dollars (1,320.4 billion dollars for imports, 120.0 billion dollars for exports). In the services sector, 34 members and four observers adopted 69 measures, a significant decrease from 2024, mostly liberalising conditions for service suppliers or enhancing regulatory frameworks, demonstrating a commitment to services trade despite the challenging environment. Economic support measures, including subsidies, stimulus packages, state aid, and export incentives, shifted since April 2025 from direct support to regulatory tools targeting climate change mitigation, supply security, and national security. Following the Director-General’s request for information on March 5, 2025, 34 members reported 100 measures, down from 224 in 2024. The Secretariat’s research, complemented by external data from the Global Trade Alert (GTA), indicates additional unreported support measures with trade implications, highlighting the evolving focus on strategic policy objectives beyond traditional economic goals.

WTO Director-General Ngozi Okonjo-Iweala underscored the trade disruptions, stating, “This Trade Monitoring Update reflects the disruptions we have been seeing in the global trading environment, with a sharp increase in tariffs. Only six months ago, about 12.5 per cent of world merchandise imports were impacted by such measures that had accumulated since 2009. That share has now jumped to 19.4 per cent.” She emphasised dialogue, noting the U.S.-China agreement on May 14 in Geneva suspending most tariffs until mid-August, followed by London talks on June 11 easing Chinese rare earth export controls, reflecting mutual interest in maintaining the tariff pause. The U.S.-U.K. deal on May 8, with implementation on June 16 for tariff reductions on aerospace goods and U.K. vehicle tariff-rate quotas, awaits legislative approval for U.S. ethanol and U.K. steel measures. U.S. measures since early 2025, targeting steel, aluminum, vehicles, and vehicle parts and justified on national security and economic emergency grounds, prompted varied responses: Canada and China implemented countermeasures, the European Union suspended retaliatory tariffs until mid-July, while ASEAN, Australia, Argentina, Chile, Montenegro, New Zealand, Papua New Guinea, South Africa, and Chinese Taipei opted against retaliation, and Brazil, Colombia, Mexico, and others considered it. Some members offered concessions on U.S. imports or sought tariff exemptions to facilitate dialogue. Further tariff increases are possible, with delays until July 9 or August 12 to allow negotiations. Okonjo-Iweala urged WTO members to pursue WTO-consistent approaches and deep reforms to address underlying trade issues and lower tensions.

The 2024 trade performance showed merchandise trade volume growth of 2.9 per cent, outpacing global GDP growth of 2.8 per cent, the first such occurrence since 2017 outside the post-pandemic rebound, with commercial services trade growing by 6.8 per cent. Merchandise exports reached 24.43 trillion dollars (up 2 per cent), and services exports 8.69 trillion dollars (up 9 per cent), despite declining export and import prices. The WTO emphasised cautious forecast interpretation due to rapid policy shifts and regional conflicts, with a full forecast update planned for October.

– global bihari bureau