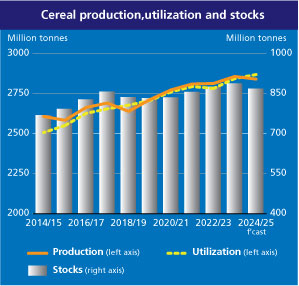

Rome: The most recent forecast for global cereal production in 2024 has been slightly reduced from last month, now estimated at just under 2,841 million tonnes, which is 0.6 per cent lower than the previous year.

This downward adjustment is mainly attributed to a notable decrease in the maize estimate for the United States, where late-season moisture stress has led to lower yields than initially anticipated, revealed the new Cereal Supply and Demand Brief released by the Food and Agriculture Organization of the United Nations (FAO), here today.

This downward adjustment is mainly attributed to a notable decrease in the maize estimate for the United States, where late-season moisture stress has led to lower yields than initially anticipated, revealed the new Cereal Supply and Demand Brief released by the Food and Agriculture Organization of the United Nations (FAO), here today.

However, this decline is somewhat balanced by upward revisions in production estimates for China and the European Union, the report said. Additionally, global forecasts for barley and wheat have been slightly lowered, reflecting new data from Australia and the European Union indicating smaller harvests than expected. In terms of rice, recent official assessments since December 2024 have shown improved production figures in China, Mali, Nepal, and Vietnam, which have compensated for minor downgrades in output for the Philippines and Senegal.

Consequently, global rice production is projected to reach a record high of 539.4 million tonnes (milled basis) in 2024/25, an increase of 0.6 million tonnes from December forecasts and 0.9 per cent higher than in 2023/24.

Looking towards the 2025 crop season, the primary planting season for winter wheat in northern hemisphere nations concluded in January. Initial reports from the European Union suggest a rise in sowing activities, particularly for soft wheat, with France and Germany leading this increase. The weather has been mostly favourable in recent months. While February may bring drier conditions, wheat yields are expected to improve in 2025 after last year’s disappointing results, enhancing the chances of a production rebound. In the United Kingdom, the area dedicated to winter wheat is projected to recover after last year’s challenging planting conditions reduced the cultivated land. Conversely, in the Russian Federation, unfavourable weather has led to a decrease in plantings, and unusually warm temperatures in early 2025 have reduced snow cover, raising the risk of winterkill and potentially causing a slight decline in production. In India, attractive prices and ongoing favourable weather contribute to a positive outlook for the 2025 wheat harvest.

In the southern hemisphere’s key coarse grain-producing nations, the 2025 harvest is anticipated to begin in the second quarter. Argentina is expected to see a decrease in maize acreage compared to last year, as farmers are worried about the effects of stunt disease spread by leafhoppers, which impacted production in 2024. Nevertheless, favourable weather conditions anticipated in the coming months suggest generally positive yield prospects. In Brazil, stronger maize prices may lead to a slight rise in overall plantings beyond initial forecasts, with year-on-year yield improvements expected. However, there are lingering concerns about the delayed sowing of soybeans, which could postpone the planting of the main safrinha maize crop. In South Africa, record-high maize prices have spurred an increase in maize plantings. Improved weather conditions following inconsistent rainfall in late 2024 have led to yield prospects that are average to above average.

Global cereal consumption for the 2024/25 period is projected to increase by 0.9 per cent or 24.5 million tonnes, compared to the 2023/24 figures, totalling 2,869 million tonnes. This marks an increase of 9.8 million tonnes since the December report. The primary contributor to this rise is an 8.4 million tonne adjustment in coarse grain usage for 2024/25, largely driven by a higher anticipated demand for maize, particularly for animal feed, bringing the total forecast to 1,535 million tonnes, which is 1.0 per cent (14.7 million tonnes) higher than the previous year. In contrast, the global wheat utilization forecast for 2024/25 is slightly up at 797.2 million tonnes, reflecting a modest increase of 0.8 million tonnes since December, remaining close to last year’s levels. This is due to a rise in food consumption that offsets a decrease in wheat feed usage. Additionally, world rice consumption is expected to grow by 1.9 per cent in 2024/25, reaching a record 537.2 million tonnes, which is about 500,000 tonnes higher than earlier December estimates, driven by increased usage in several African nations, despite a less optimistic outlook for domestic consumption in India.

FAO’s latest forecast for world cereal stocks by the close of seasons in 2025 has been revised downwards by 7.8 million tonnes, now pointing to a 2.2 per cent decline (19.3 million tonnes) below opening levels to 866.6 million tonnes.

Despite this anticipated reduction in stocks, the global cereal stocks-to-use ratio for 2024/25 is expected to remain at a satisfactory level of 29.8 per cent, although it is a decline from the 30.9 per cent recorded in 2023/24. The total coarse grain stocks have been adjusted downwards by 6.1 million tonnes from the previous forecast, now standing at 354.2 million tonnes, reflecting a 3.8 per cent (14.1 million tonnes) decrease from the opening levels. This revision is primarily attributed to a significant reduction of 10.1 million tonnes (20.5 per cent) in maize stocks in the United States, driven by lower production and increased export expectations. Additionally, global wheat inventories have decreased by 1.3 million tonnes this month, resulting in a total of 308.4 million tonnes, which is a 2.9 per cent decline from the opening levels. This adjustment is largely due to a 3-million-tonne reduction in wheat stocks in China, stemming from lower anticipated imports. Furthermore, the FAO has lowered its forecast for world rice stocks after the 2024/25 marketing years by 500,000 tonnes since December. Nonetheless, it still projects a 2.0 per cent increase in global rice stockpiles, reaching a record high of 204.0 million tonnes, supported by expected stock rebuilding among rice-importing nations and a sufficient aggregate level of reserves in rice-exporting countries.

World cereal trade for the 2024/25 period is projected to decline by 5.6 per cent, equating to a reduction of 28.7 million tonnes, remaining largely consistent with the previous estimate of 483.5 million tonnes. The global trade in coarse grains for the same period (July/June) is anticipated to reach 227.7 million tonnes, reflecting a decrease of 6.8 per cent or 16.5 million tonnes compared to the 2023/24 figures. The diminished demand from China for barley and maize has led to downward adjustments in the global trade forecasts for both commodities, with barley expected to decrease by 2.1 million tonnes and maize by 0.7 million tonnes. Additionally, lower export projections for barley from Australia and the European Union, as well as for maize from Brazil, India, and the Russian Federation, have further contributed to the pessimistic trade outlook. The FAO has also revised its wheat trade forecast for 2024/25 downwards by 1.5 million tonnes since December, now estimating it at 196.7 million tonnes. China’s wheat import forecast has been adjusted to its lowest level since the 2019/20 period, reflecting a slower-than-expected import rate and anticipated reductions in domestic feed demand. Export projections for the European Union have been lowered due to tighter supply conditions, while the Russian Federation faces a slowing export pace and an export quota of 10.6 million tonnes from mid-February to the end of June, marking the lowest quota in five years. In terms of rice trade, international projections for 2025 (January-December) have been revised upward to 59.1 million tonnes, an increase from the revised estimate of 58.4 million tonnes for 2024 and 3.5 million tonnes higher than reported in December. India is expected to lead the export growth in 2025, with Brazil, Myanmar, and Uruguay also anticipated to increase their shipments throughout the year.

Meanwhile, the FAO Food Price Index, the benchmark for world food commodity prices, declined in January, averaging 124.9 points during the month, down 1.6 per cent from its December level. The drop was driven by significant decreases in the international quotations for vegetable oils and sugar.

The index, which tracks monthly changes in the international prices of a set of globally traded food commodities, was 6.2 per cent higher than its corresponding level one year ago but remained 22.0 per cent below its peak reached in March 2022.

The Agricultural Market Information System (AMIS), hosted by FAO, also released its monthly Market Monitor today. In addition to the regular market analysis, the report’s feature article highlights a study of 144 major crops over the 1961-2021 period, finding no evidence of long-term deceleration in global yield growth, while urging the development of cultivars resilient to temperature and precipitation variations.

– global bihari bureau