Global Grain Trade to Expand

FAO Index Dips as Supplies Grow

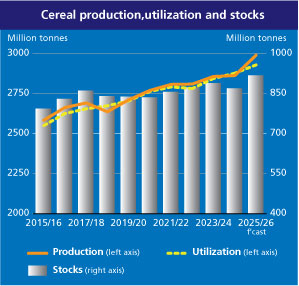

Rome: World cereal production is forecast to reach a record 2,990 million tonnes in 2025, up 4.4 per cent from 2024, including rice in milled equivalent, according to the updated forecasts for global cereal markets, released by the Food and Agriculture Organization of the United Nations (FAO), here today.

Based on the current forecasts for global cereal production in 2025, stocks could rise by 5.7 per cent from their opening levels to a record high of 916.3 million tonnes.

Outputs of all major cereals are anticipated to rise, with the largest year-on-year increase forecast for maize and the smallest for rice; both maize and rice outputs are predicted to hit new record highs. World cereal utilisation in 2025/26 is forecast at 2,929 million tonnes, up 51.9 million tonnes or 1.8 per cent from 2024/25, with growth resulting mainly from ample supplies and lower prices.

Outputs of all major cereals are anticipated to rise, with the largest year-on-year increase forecast for maize and the smallest for rice; both maize and rice outputs are predicted to hit new record highs. World cereal utilisation in 2025/26 is forecast at 2,929 million tonnes, up 51.9 million tonnes or 1.8 per cent from 2024/25, with growth resulting mainly from ample supplies and lower prices.

Feed use of cereals is expected to rise by 2.1 per cent, with major producers such as Brazil and the United States of America directing more maize to animal rations, while in Asia, strong demand from aquaculture is expected to be met through imports of feed-quality wheat. Other uses of cereals, particularly maize, are also set to increase.

Human consumption of cereals is forecast to rise marginally, reflecting population growth and gradual dietary shifts.

Global maize inventories are expected to expand the most, especially in North America, followed by wheat and barley, while global sorghum stocks may decrease slightly.

World rice stocks at the close of the 2025/26 marketing year are forecast to rise by 2.2 per cent to a new peak of 215.4 million tonnes.

Overall, the global cereal stocks-to-use ratio in 2025/26 is predicted to rise to 31.1 per cent, the highest level since 2017/18. World trade in cereals in the 2025/26 season is anticipated to expand by 3.2 per cent to 499.5 million tonnes.

Wheat trade (July/June) is expected to rise by 9.9 million tonnes, or 5.1 per cent, from the previous season, driven largely by Asian imports, which are forecast to increase by 15.6 million tonnes.

Global trade in coarse grains is anticipated to expand amid relatively low export prices and stronger demand for animal protein, though traded volumes will likely remain below the 2023/24 peak. By contrast, global rice trade is forecast to decline by 1.2 per cent to 61.1 million tonnes in 2026.

Record-high cereal production forecast at 2,990 million tonnes in 2025, combined with lower October 2025 prices for maize, barley, sorghum, and feed-quality wheat, supports expanded global livestock feed availability and reduced costs for animal production. Feed use of cereals is projected to rise 2.1 per cent in 2025/26, accounting for the majority of the 1.8 per cent increase in total cereal utilisation to 2,929 million tonnes. Major producers Brazil and the United States are directing larger maize volumes to animal rations, while Asian aquaculture demand drives imports of lower-priced feed wheat.

Coarse grain prices fell 1.1 per cent in October, with maize quotations easing despite localised yield concerns in the European Union and United States, and wheat prices dropped 1.0 per cent amid ample southern hemisphere supplies. Global maize inventories are expected to expand the most, concentrated in North America, contributing to a record 916.3 million tonnes in total cereal stocks and a stocks-to-use ratio of 31.1 per cent. These factors lower feed-to-meat price ratios, enhancing profitability in poultry, pork, and dairy sectors, though rising vegetable oil prices may increase costs for oilseed meal co-products used in compound feeds.

The FAO Food Price Index averaged 126.4 points in October 2025, down 1.6 per cent from a revised September level of 128.5 points, marking the second consecutive decline and placing it slightly below the year-ago value while remaining 21.1 per cent below the March 2022 peak. Ample global supplies drove the overall softening, with declines across cereals, meat, dairy, and sugar outweighing a rise in vegetable oils.

The Cereal Price Index fell 1.3 per cent to 103.6 points, down 9.5 per cent year-on-year. Wheat quotations dropped 1.0 per cent amid favourable southern hemisphere harvests and steady northern winter plantings. Coarse grains declined 1.1 per cent, with lower prices for barley, maize, and sorghum, though partially offset by yield concerns in the European Union and United States and U.S.-China trade developments. Rice prices fell 2.5 per cent due to harvest progress and intensified export competition.

Meat prices decreased 2.0 per cent to 125.0 points, ending an eight-month rise but still 4.8 per cent above last year. Sharp drops in pig and poultry quotations reflected abundant supplies and weaker Chinese demand, with EU pig exports pressured by new duties and Brazilian poultry redirected due to avian influenza restrictions. Ovine prices eased with larger Australian supplies, while bovine meat rose on firm global demand.

Dairy quotations declined 3.4 per cent to 142.2 points, the fourth straight drop, though 2.7 per cent above year-ago. Butter fell 6.5 per cent on strong EU and New Zealand export availability and subdued Asian demand; whole milk powder dropped 6.0 per cent, skim milk powder 4.0 per cent, and cheese 1.5 per cent amid adequate supplies and limited buying interest.

Sugar prices plunged 5.3 per cent to 94.1 points, the lowest since December 2020 and 27.4 per cent below last year, driven by robust Brazilian output, expected increases in Thailand and India, and reduced biofuel demand from lower crude oil prices.

In contrast, vegetable oils rose 0.9 per cent to 169.4 points, the highest since July 2022. Palm oil rebounded on tighter Indonesian supplies ahead of 2026 biodiesel mandates; sunflower oil gained for the fourth month on Black Sea harvest delays; rapeseed rose on EU tightness; and soy advanced on strong domestic demand in Brazil and the United States.

Export restrictions on staples have eased in Argentina, India, and the Russian Federation. These market dynamics strengthen global food security in the near term. Record production, utilisation, and stock levels, alongside a decade-high stocks-to-use ratio, enhance physical availability. Price declines in key staples improve economic access for import-dependent low-income countries in Asia and sub-Saharan Africa. Eased export restrictions and rising trade volumes support efficient distribution.

However, elevated vegetable oil prices and persistent regional challenges—such as currency weakness, logistical constraints, or localised production shortfalls—may limit benefits for vulnerable populations.

– global bihari bureau