Rome: International cereal quotations have dipped, vegetable oil prices have risen, and record grains harvest is expected in the year ahead.

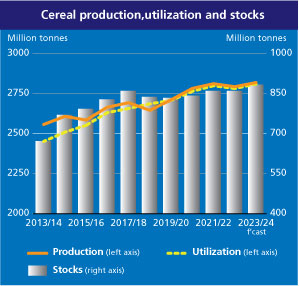

The Food and Agriculture Organization of the United Nations (FAO)’s forecast for world cereal production in 2023 has been raised by 3.6 million tonnes this month, reflecting improved prospects for wheat and, to a lesser extent, coarse grains.FAO raised its forecast for this season’s harvests in a new Cereal Supply and Demand Brief, released today. World cereal production in 2023 is now pegged at 2,823 million tonnes, up 0.9 per cent (25.9 million tonnes) from the previous year and 10.3 million tonnes above the previous record high reached in 2021.

The forecast for global wheat production in 2023 was lifted by approximately 2 million tonnes this month to 787 million tonnes, but it is still seen down 2.1 per cent (17.1 million tonnes) from the 2022 level

Upward revisions were made for wheat output in the Russian Federation and Türkiye and for maize in the United States of America, while production forecasts were reduced somewhat for Argentina and Brazil. Meantime, the forecasts for maize production were trimmed for the European Union and Mexico. FAO also expects global rice production in 2023/24 to rise by 0.8 per cent from the previous marketing season.

Upward revisions were made for wheat output in the Russian Federation and Türkiye and for maize in the United States of America, while production forecasts were reduced somewhat for Argentina and Brazil. Meantime, the forecasts for maize production were trimmed for the European Union and Mexico. FAO also expects global rice production in 2023/24 to rise by 0.8 per cent from the previous marketing season.

Looking ahead to the next season, planting of the 2024 winter wheat crop is ongoing in the northern hemisphere countries and, reflecting lower crop prices, area growth could be limited. Sowing of the 2024 coarse grain crops is ongoing in the southern hemisphere countries, with slower sowings in Brazil but a rebound in Argentina.

World cereal total utilization in 2023/24 is forecast at 2,813 million tonnes, 1.1 per cent higher than in 2022-23.

World cereal stocks by the close of seasons in 2024 are predicted to rise by 2.7 per cent above their opening level and mark a new record high. Based on the latest forecasts, the global cereal stock-to-use ratio would be 30.8 per cent in 2023/24, indicating an overall comfortable supply level.

World trade in cereals in 2023-24 is forecast to contract slightly to 468.4 million tonnes, down 1.8 per cent from the 2022/23 level.

Meanwhile, the benchmark for world food commodity prices was broadly stable in November, with lower international cereal quotations offset by higher prices of vegetable oils, FAO reported Friday.

The FAO Food Price Index, which tracks monthly changes in the international prices of a set of globally traded food commodities, averaged 120.4 points in November, unchanged from its level in the previous month and 10.7 per cent lower than in November 2022.

The FAO Cereal Price Index decreased by 3.0 per cent from October. International prices of coarse grains dropped by 5.6 per cent, led by a sharp fall in maize prices, while those of wheat declined by 2.4 per cent in November. The FAO All Rice Price Index remained stable month-on-month amidst contrasting price movements across different origins and market segments.

The Vegetable Oil Price Index, meanwhile, increased by 3.4 per cent from October. International palm oil prices rebounded by more than 6.0 per cent in November, chiefly underpinned by more active purchases by leading importing countries and seasonally lower outputs in major producing countries. World sunflower oil prices rose moderately, while quotations for soy oil and rapeseed oils dropped slightly in November.

The FAO Dairy Price Index rose 2.2 per cent from October, led by high import demand for butter and skim milk powder from Northeast Asian buyers, along with increased internal demand ahead of the winter holidays in Western Europe.

The FAO Sugar Price Index rose by 1.4 per cent month on month, averaging in November as much as 41.1 per cent higher than its level in the same month last year, influenced by heightened concerns over global export availabilities amid worsening production prospects in two leading exporting countries, Thailand and India, due to severe dry weather conditions associated with the El Niño event.

The FAO Meat Price Index dipped 0.4 per cent from October, reflecting minor drops in the world prices of poultry, pig and bovine meats, driven mostly by ample exportable supplies.

– global bihari bureu