![]() By Venkatesh Raghavan*

By Venkatesh Raghavan*

The current political turmoil in Pakistan after the arrest of former Prime Minister Imran Khan on charges of corruption on May 9, 2023, spreading over to the streets now, only further contributes to the imminent making of the South Asian nation a failed state.

The political developments intertwined with the economic distress only heighten an air of uncertainty about Pakistan receiving the much sought-after financial bailout from the International Monetary Fund (IMF). The uncertainty factor was flagged soon after the Pakistani rupee touched an all-time low of 290.18 against the US dollar this month.

The International Monetary Fund (IMF) bailout is still nowhere near in sight, and the latest trade deficit figures stand at 236839 million Pakistani rupees.

The political turmoil in the country has only increased the country’s default risk as the IMF may delay any bailout loan. Even just a few days prior to Imran’s arrest, which further makes Pakistan’s credibility take a hit, the IMF Managing Director Kristalina Georgieva, while addressing a question on the possibility of Pakistan’s debt restructuring, had pointed out the absence of a policy framework that could make it possible for IMF and Pakistan to avoid a situation like Ghana or Sri Lanka, “to get to a point when the debt of Pakistan may become unsustainable”. She said the IMF and Pakistani authorities were “currently also discussing with those who support Pakistan in terms of providing financial assurances so we can complete the programme (to make sure that Pakistan has the policy framework)”.

This suggests that Pakistan’s economy is unlikely to receive any reprieve in the immediate future. This is despite over $200 million in recovery and reconstruction funding to Pakistan by the United States since last year’s devastating floods there.

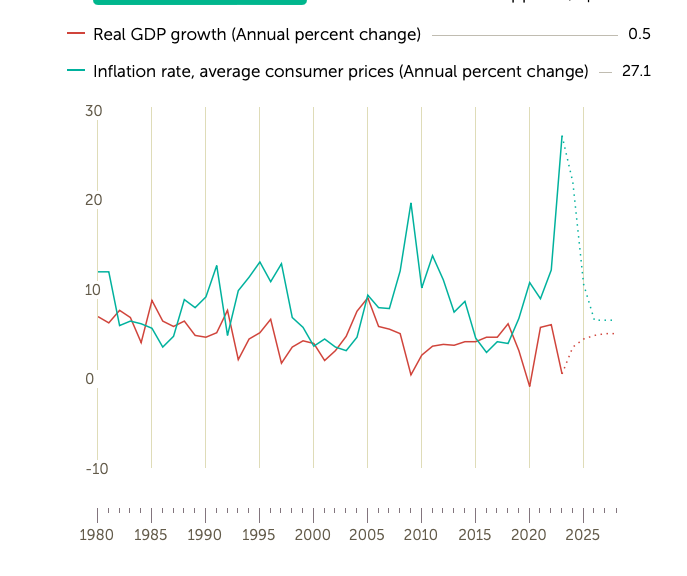

The situation is bad and Pakistan is on the verge of defaulting. As on March 31, 2023, Pakistan’s Outstanding Purchases and Loans stand at (Special Drawing Rights) SDR 5566.08 million. The country’s projected Real GDP for 2023 is (% Change) 0.5. Moreover, inflation there is close to the hyper‑inflation area, especially in food, and there is the challenge of food security in the coming years.

Pakistan Economy: IMF Data Mapper of April 2023)

The demand for the IMF bailout in Pakistan has been long pending and has been left unaddressed as the former Prime Minister Imran Khan had backed out of slashing subsidies in the country after committing himself to the same while receiving the previous IMF package. While this continues to hang fire, the IMF is seen to be reluctant owing to the country’s track records proving it to be a willful defaulter on terms of its bailouts.

As of now, Pakistani citizens are confronted with a free-falling rupee, spiralling inflation and an acute energy shortage. The IMF has also clearly indicated that it desires all stakeholders in the loan programme, meaning the inclusion of all political parties to process the financial deal. However, the warring factions of rivals Shehbaz Sharif (current Prime Minister) and Imran Khan (former Prime Minister) are unlikely to see eye to eye on this matter. While inflation including retail inflation has crossed the 28% mark, the IMF still continues to insist that the Pakistani rupee should be allowed to float and find its own level. Needless to say, this will imply that prices of most essentials and daily items of use will skyrocket unmanageable.

The situation on the ground worsened after Pakistan’s Central banker decided to release foreign exchange reserves, going against the government’s diktat to put a stop to releasing the funds. This drew a lot of angst and outcry from the masses as it was seen to be a move to facilitate the import of luxury cars by the elite aristocratic sections of the society when the country could ill-afford such indulgences. In addition, there has been a steep rise in prices of petrol, diesel and kerosene accentuating the energy crisis acutely.

As for the energy sector, Pakistan now pins its hopes on a USD 2.7 billion 1,100 megawatts capacity nuclear reactor under China-Pakistan Economic Corridor funded by China. The move is expected to provide some relief from the acute power shortage situation that is currently bogging the country.

Meanwhile, the continued failure on the part of the importers to procure their requirements from overseas destinations, in resource-intensive industries like textiles, has proven to be a body blow for Pakistan’s already sagging economy. The textile fold which used to employ upward of a million workers both skilled and semi-skilled is faced with a total outage, with more than 150 plants getting shut down, owing to their inability to import dye. The lack of foreign exchange reserves has also adversely affected the ground situation at Karachi Port. The port has turned into a bottleneck with several thousands of containers getting stuck there with no scope for any relief in the absence of foreign exchange to make payment for their release.

Still worse, economists cite that even if the IMF loan gets disbursed, it can at best be a source of temporary relief, maybe up to six months. In addition, a high chunk of the loan amount will get blown up in Pakistan’s effort to pay off its creditors. Pakistan is also faced with hardships owing to a global meltdown precipitated by the Ukraine war and limited scope for monetary relief supplies.

*Senior journalist