By Sudeep Sonawane

By Sudeep Sonawane

The International Monetary Fund’s [IMF] latest World Economic Outlook [WEO] has raised prospects of India’s economic growth for fiscal year 2023. Report authors state this on expected improvement to credit growth, better investment and consumption. The report expects “better than anticipated performance of India’s financial segment”.

The Economic Survey 2021-22 released by India’s finance ministry corroborates IMF’s optimistic outlook.

Advance estimates “expects Indian economy to witness real GDP expansion of 9.2 per cent in 2021-22 after contracting in 2020-21. This implies overall economic activity has recovered from the pre-pandemic levels. Almost all indicators show the economic impact of the “second wave” in Q1 was much smaller than the full lockdown phase in 2020-21”.

Global economy entered 2022 in a weaker position than expected. The report points to adverse events since October 2021 set off by fresh attack by Corona virus. The Omicron variant has restricted movement of people and disrupted goods supply. “The Omicron variant that arrived late November threatens to set back this tentative path to recovery,” the report says.

Among other adverse events, the report cites, higher and broad-based inflation, particularly in the Unites States, real estate layoffs in China and weaker recovery in private consumption.

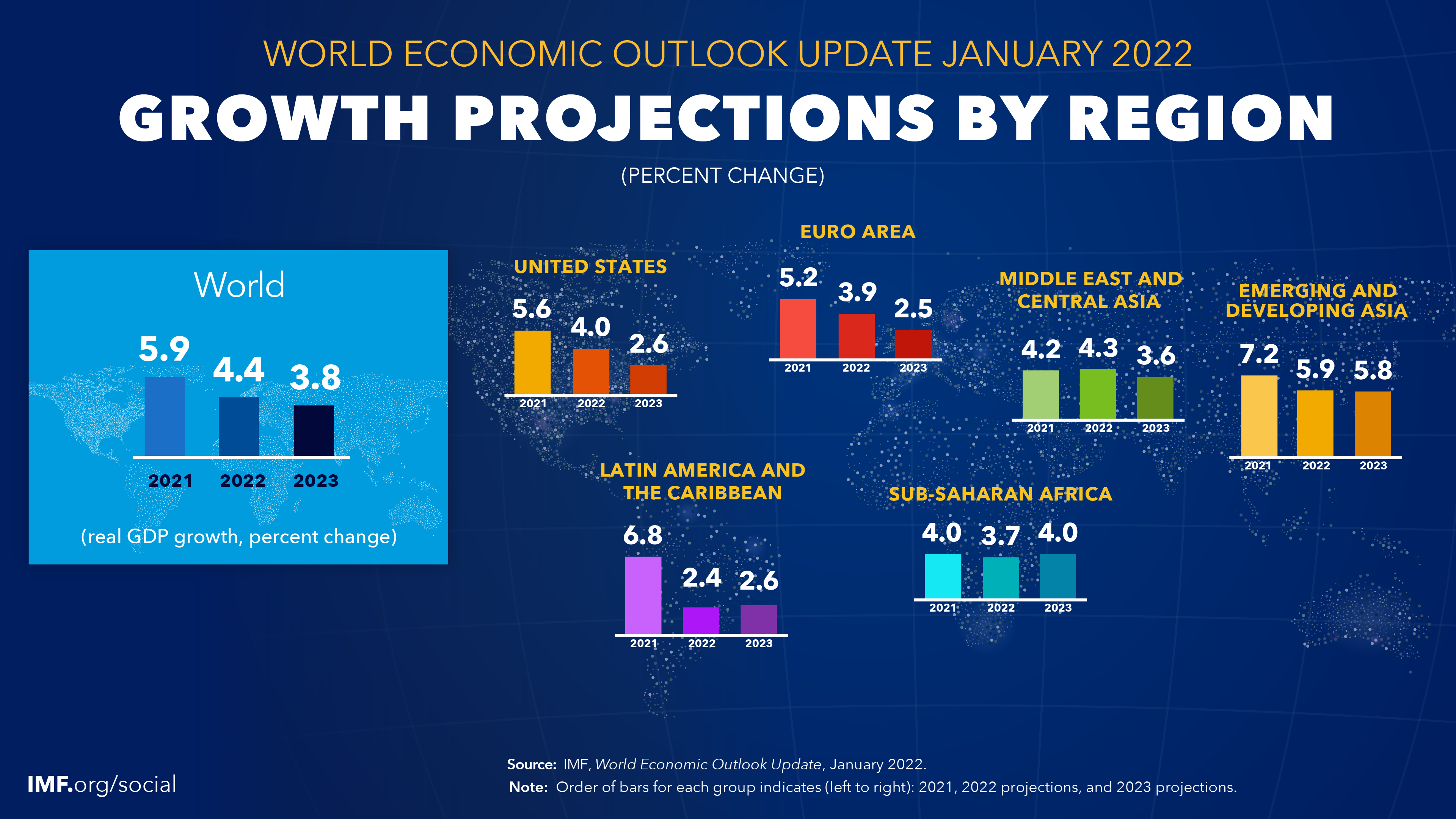

The report projects cumulative global growth over 2022 and 2023 to stay 0.3 percentage point lower than previously forecast. The upward revision to global growth in 2023 is mostly mechanical. Eventually, the shocks dragging 2022 growth will dissipate and—as a result—global output in 2023 will grow a little faster.

The report expects inflation to remain elevated in the near term, averaging 3.9 percent in advanced economies and 5.9 percent in emerging market and developing economies in 2022, before subsiding in 2023.

Also read:

- Real GDP for 2020-21 shows contraction of 6.6%

- Economic Survey 2021-22: Government for enhanced private investment in agriculture

- Global body raises outlook for India’s 2023 economic growth

- Combined Index of 8 core industries rises by 3.8% in December 2021

- Economic Survey 2021-22: Key Highlights

- Corona inspired us to achieve our goals at the fastest possible pace: President Kovind

“Assuming medium-term inflation expectations remain well anchored and the pandemic eases, higher inflation should fade as supply chain disruptions ease, monetary policy tightens, and demand rebalances away from goods-intensive consumption towards services.”

The report expects the rapid increase in fuel prices to moderate during 2022–23. “This will help contain headline inflation,” it says.

Futures markets indicate oil prices will rise around 12 percent and natural gas prices around 58 percent in 2022 (both considerably lower than the increases seen in 2021) before retreating in 2023 as supply-demand imbalances recede further.

The report expects food prices to increase at a more moderate pace of around 4.5 percent in 2022 and decline in 2023.

In many countries, nominal wage growth remains contained despite employment and participation returning almost to pre-pandemic levels. In the United States a sharp decline in unemployment comes along with buoyant nominal wage growth. This suggests a degree of tightening in US labour markets not evident elsewhere.

If US labour force participation remains below pre-pandemic levels and discouraged workers remain on the side lines, tighter labour markets may feed through to higher prices. As a result, the US Federal Reserve said in December 2021 it will taper asset purchases at a faster pace and signalled that the federal funds rate will likely be raised to 0.75–1.00 percent by the end of 2022, some 50 basis points higher than in the previous guidance.

The report anticipates United States’ less accommodative monetary policy to prompt tighter global financial conditions. This will put pressure on emerging market and developing economy currencies. Higher interest rates will make borrowing more expensive worldwide and strain public finances. For countries with high foreign currency debt, the combination of tighter financial conditions, exchange rate depreciations, and higher imported inflation will lead to challenging monetary and fiscal policy trade-offs. Although fiscal consolidation is anticipated in many emerging market and developing economies in 2022, high post-pandemic debt burdens will be an ongoing challenge for years to come.

The report projects global economy to moderate in 2022 and 2023, in line with the overall pace of the expansion. Assuming the pandemic eases over 2022, it anticipates supply chain problems to abate later this year. The accompanying moderation in global goods demand will help reduce imbalances. Cross-border services trade, particularly tourism, will remain subdued.