Banks’ contribution to NPS Corpus of PSU Bank employees to be enhanced to 14%

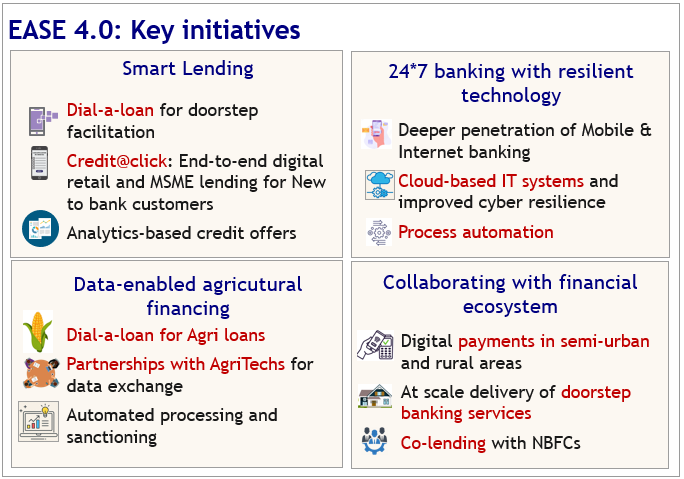

Finance Minister unveils 4th edition of Public Sector Bank Reforms Agenda – EASE 4.0

Mumbai: Riding on the profit registered by the Public Sector Banks, the Government has approved the Indian Banks’ Association’s (IBA) proposal to increase the family pension to 30% of last salary drawn.

The move would make family pension go up to as much as Rs 30,000 to Rs 35,000 per family of bank employees. This was announced by the Secretary, Department of Financial Services, Ministry of Finance, at a press meet addressed by Finance Minister Nirmala Sitharaman here today. Sitharaman today unveiled the fourth edition of the Public Sector Bank (PSB) Reforms Agenda ‘EASE 4.0’ for 2021-22 – tech-enabled, simplified, and collaborative banking. She unveiled the annual report for the PSB Reforms Agenda EASE 3.0 for 2020-21 and participated in the awards ceremony to felicitate best performing banks on EASE 3.0 Banking Reforms Index.

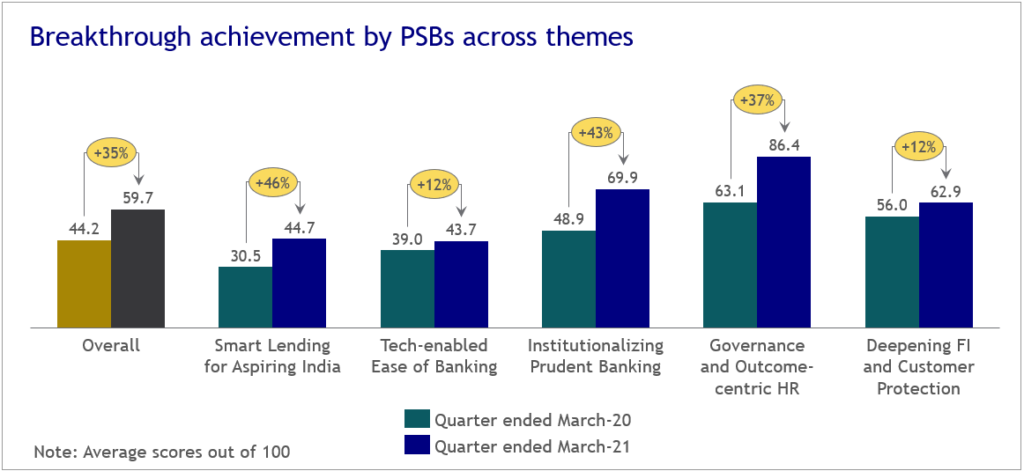

Public Sector Banks have reported profits and have accelerated on technology-driven reforms. These banks have reported a profit of Rs. 31,817 crore in FY21 as compared to a loss of Rs. 26,016 crore in FY20. This is the first year when PSBs have reported profit after five years of losses. Total gross non-performing assets stood at Rs. 6.16 lakh crore as of March 2021 – a reduction of Rs. 62,000 crore from March 2020 levels.

Besides, nearly 72% of financial transactions happening at PSBs is now happening through digital channels. PSBs are now offering services across call centres, Internet banking, and Mobile banking in 14 regional languages such as Telugu, Marathi, Kannada, Tamil, Malayalam, Gujarati, Bengali, Odia, Kashmiri, Konkani, Hindi, Punjabi, Assamese for the ease of customers.

For continual improvement in coverage under financial inclusion initiatives, there was a 13% growth in transactions provided by Bank Mitras in rural areas and 50% growth in enrolments in Micro personal accident insurance in Q4FY21 compared to Q4FY20.

Meanwhile, Secretary, DFS informed that, in continuation of the 11th bi-partite settlement on wage revision of public sector bank employees, which was signed by the IBA with the unions on November 11, 2020, there was a proposal for enhancement of family pension and also the employers’ contribution under the NPS. This has been approved by the Finance Minister, he said. Shri Panda further said that “earlier the scheme had slabs of 15, 20 and 30 percent of the pay that a pensioner drew at that point of time. It was capped subject to a maximum of Rs 9,284/-. That was a very paltry sum and Finance Minister Smt. Sitharaman was concerned and wanted that to be revised so that family members of bank employees get a decent amount to survive and sustain”.

The Government has also approved the proposal to increase employers contribution under the National Pension System to 14% from the existing 10%.

Thousands of families of PSU bank employees will be benefited by the enhanced Family Pension, while increase in employers contribution will provide increased financial security to the bank employees under the NPS.

Finance Minister, as part of her two day visit to Mumbai reviewed the performance of the public sector banks and launched EASE 4.0 reform agenda for smart banking.

– global bihari bureau